2025 Pre-Seed Trends Every Founder Should Know

Fusion's Associate Amit Shechter shares his perspective on where founders are choosing to build in 2025, how investor appetite is shifting, and what the data tells us about the pre-seed market.

2025 isn’t over yet - but at Fusion, we’re already analyzing the signals and trends from the first 10 months of the year to understand where we want to double down in the year ahead. During our annual Pre-Seed conference, we decided to give founders and investors in the audience a peek at what we’re seeing at Fusion.

In this blog post, we’ll analyze: In which categories are teams actually building? What does the average Pre-Seed startup look like in terms of team structure, traction, or product maturity?

And more importantly, what can we all learn from it?

To kick things off, I shared below some real data from the event itself.

Out of 600+ teams that applied to attend, here’s the breakdown of who actually got in.

The long tail is getting thinner.

We’re seeing fewer and fewer teams working on categories like Food, eCommerce, Education, Climate, or Supply Chain & Logistics. That’s not a coincidence. These are some of the toughest sectors to raise for in the Israeli early-stage (and namely in the Pre-Seed) ecosystem.

Even in our 2024 Pre-Seed Report, we saw the same trend - only a handful of Pre-Seed rounds per year across these verticals. So while teams might still be able to raise a first (angel) check, very few manage to raise a full round that gives them a real 12–18 month runway.

There’s a new kid on the block. He’s called PropTech.

In the last 12 months, we’re seeing a clear spike in the number of teams entering PropTech, but it’s not just quantity. It’s quality too. When we zoom into our own internal Fusion data, there’s a specific pattern:

These teams often have a CEO with deep domain expertise, just like we see in Fintech or Digital Health.

They usually have unique access to the market.

Unlike other verticals, they’re managing to generate meaningful traction in the US market from day one.

Why? In part, because PropTech go-to-market motions tend to be faster and more direct with less red tape & fewer compliance barriers, so tapping into the market, and the sales processes themselves are ‘easier’ (founders - don’t kill me for using this word).

Half of B2C teams work in the Mental Health or Wellness category.

That’s a dramatic concentration. In previous years, we didn’t see anything close to this trend, which leads us to believe it’s likely a byproduct of the last two years of conflict and uncertainty. Founders are recognizing a growing need and sense of an opportunity. But the US market is telling a different story.

Despite the interest, these teams are struggling to get early traction as most aren’t able to reach meaningful user scale before their first fundraising attempt. and as a result, most aren’t able to raise.

It makes sense when you think about it. These are the kinds of products that are easier to build, cheap to launch, and often characterized by the fast-initial-feedback-loop from user engagement. But that early momentum can be misleading. The harder part is building a company around it.

Zooming Out: What Fusion’s Internal Data Shows Us

From the graph below & a high-level perspective, the macro landscape hasn’t changed dramatically. But when we look closer at the numbers, we’re seeing a few important shifts in where founders are choosing to build, and what that says about how the market is evolving.

Some verticals are shrinking fast.

In 2025, the number of teams building in FoodTech and AgTech dropped by ~25%. In eCommerce and Supply Chain & Logistics, the decline was even sharper—nearly 50%. That’s a steep drop, which also mirrors what we’re seeing on our dealflow: founders who are raising Pre-Seed money are starting to ‘avoid’ the verticals that have historically been hard to raise for.

But while we’re seeing some categories ‘disappearing’, the truth is that the Pre-Seed category is growing. We’re seeing more teams that opt to raise their Pre-Seed round; the only difference is that they’re shifting focus:

Vertical SaaS/AI → up 15% YoY

Digital Health → up 20% YoY

PropTech & ConTech → up 100% YoY

That’s not a fluke - it’s ecosystem maturity. Founders are becoming more strategic. They’re choosing verticals where early traction is more attainable, investor appetite is higher, and the path to Seed is clearer.

Similar to Life Science startups which tend to raise their first check from incubators or government/innovation grants, or Cyber/Infra teams that raise large $6–8M Seed rounds to support heavy technical lift (and talent); we’re seeing the rest of the ecosystem split into distinct funding patterns. For categories like Gaming, Healthcare, Fintech, LegalTech, EdTech and more, Pre-Seed is becoming the default entry point.

Traction builds conviction, but is it realistic in Pre-Seed?

We’ve all seen the posts:

“AI makes it 10x easier to build.”

“Shipping an MVP takes days, not months.”

“Founders are more empowered than ever.”

But - easier to build ≠ paying customers.

In 2025, less than 20% of the teams we met at the Pre-Seed stage had any kind of paying customers. That’s a drop from 31% in 2024.

So we dug deeper: What’s happening with the teams that don’t have paying customers yet? Here’s what we found - less than 50% had any form of real market validation (pilots/design partnership, or a structured user discovery).

This means that only one out of every three Pre-Seed teams actually manages to convert their potential customers from pilots/design partnerships to paying customers.

That’s a bottleneck. Here are a few questions one might want to ask oneself when working with customers:

What will trigger the end of a pilot?

What KPIs matter to this customer?

What accelerates or delays conversion?

Should we ask for payment up front to validate urgency?

Of course, there are many more, but these are a few signals investors are tracking, and as the bar keeps rising, getting this right might make the difference between a good story and a funded one.

More Solopreneurs, Fewer Co-Founder Pairs - and B2B Still Dominates

Let’s talk about who’s actually building these companies, and who they’re building for.

The data (on the left side of the graph) is pretty clear: nearly 80% of Pre-Seed teams we met in the local ecosystem are selling to businesses (B2B). Roughly one-third of those are operating in a B2B2C model.

On the other (right) side of the graph, we can see a comparison between 2024 (inner ring) and 2025 (outer ring) data. There’s been an 8% increase in solo founders, and a 5% drop in the number of two-person founding teams. We believe this is a direct result of the generative AI wave. Tools like Cursor, Claude Code, Base44, Loveable, and others have made it easier than ever to launch something alone, and many did, but we’re already starting to see the limits of that model.

Looking ahead to 2026, I believe we’ll see a shift in the other direction, and we’re likely to see a sharp decline in the number of solo-founder teams, a correction after the solo-founder boom we’ve seen over the last two years.

Actually, we’re already seeing (shoutout to CrustData) a decline in usage across tools like Loveable and others (as of October 2025), suggesting that the solo-founder playbook might not scale as well as people thought.

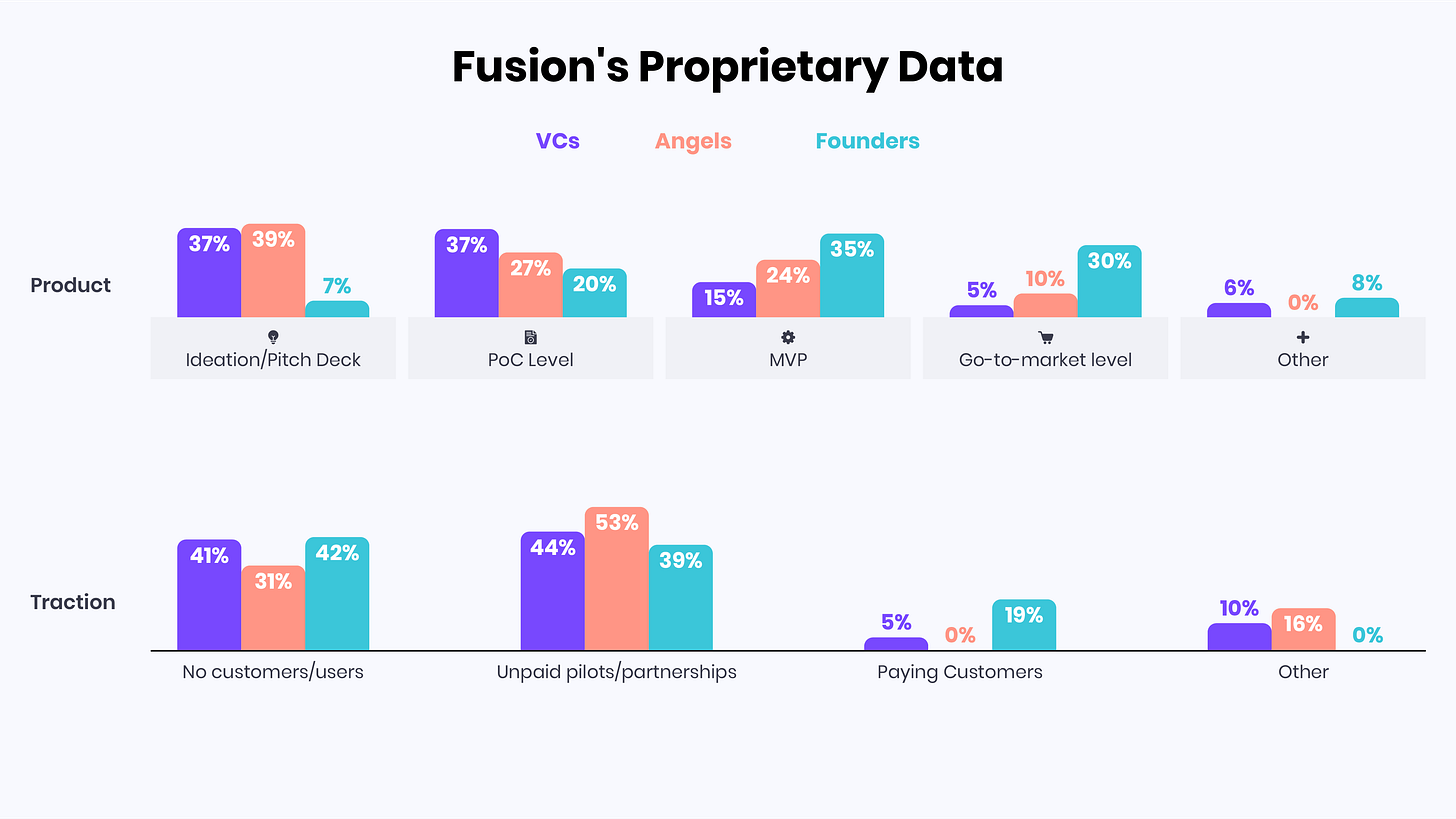

What Investors Say They Want vs. What Founders Actually Have

On the left side of the graph below, you’ll see data from our 2024 Pre-Seed report, where we asked top Israeli angels and VC funds what they expect from founders at the Pre-Seed stage in terms of product maturity and traction. On the right side, you’ll see what we actually observed from the founders we met at Fusion in 2025.

At first glance, things seem pretty aligned, but there are two big gaps that stand out:

Pre-Seed on a deck is nearly dead.

The majority of the founders we meet are showing real products; whether it’s a functional MVP or something more mature, ready for early go-to-market. If you’re raising a full round, and not just a small check to get things going and have some resources to play with - you’re expected to have something tangible. The bar has risen. The idea stage is not a category where you’ll find first-time founders raising Pre-Seed.

Investors say they don’t require pilots, but they kind of do.

Many investors say that formal pilots or design partnerships aren’t necessary when raising your first funding round (Pre-Seed or Seed). But in practice? That’s almost always their next question. From our conversations with dozens of funds, it’s clear that validation, especially early signs of “willingness to pay”, carries serious weight. It doesn’t make ‘No’ a ‘Yes’, but it definitely can change a ‘No’ to ‘Interesting. Perhaps we should take a closer look.’

We hear on many panels that customer/user interviews and feedback are good signals, but the truth is that, in more challenging and non-trivial markets, regulated industries, complex GTM motions, or new tech categories, those signals often aren’t strong enough.

Two Things I’m Watching for in 2026 (and Beyond)

As we look ahead, here are a couple of my personal takeaways that I believe will shape how early-stage funding evolves, namely at the Pre-Seed level.

More local first checks. More international follow-on.

In non-obvious verticals like DeepTech, Supply Chain, SpaceTech, LegalTech and many others - we’re starting to see a consistent pattern. Founders raise their first check locally, often from Pre-Seed funds or angels who know the ecosystem. Then, when they’re gearing up to raise the entire funding round, they’re increasingly turning to foreign capital, such as from US and European investors/funds.

We’re already seeing this play out at Fusion. In the past year alone, nearly five teams we backed went on to raise Pre-Seed or Seed rounds from US (80%) and European (20%) investors. For first-time founders in these verticals, it’s becoming almost impossible to raise a full round solely from Israeli capital.

Pre-Seed rounds will get smaller and more focused.

While we do expect to see more teams entering the Pre-Seed market, mainly due to the current challenging fundraising landscape, we believe that we’ll see a decline in round sizes across the Pre-Seed space.

Why? As we already discussed in the past, early-growth funding changes, and this means early-stage investors demand more proof before they put their skin in the game. They’re shifting to a “do more with less” mentality. So how (I believe) can founders adjust?

Raise $500K–$750K, stretch it for 12 12-month runway, build a solid product, generate real revenue, and then raise a strong Seed round with 24+ months of runway. That’s the new playbook.

And as always - now, it’s time for all of us to get back to work

Really valuable data on pre-seed traction gaps, Amit. The pilot-to-paying-customer conversion challenge is something TCLM explores through a trade credit and working capital lens - especially how payment terms and collections impact early-stage cash flow. Might be useful for founders thinking about the financial side of scaling.

(It’s free)- https://tradecredit.substack.com/