7 Lessons from Investing in 30 Startups in Two Years

After meeting hundreds of founders, Fusion’s Associate Amit Shechter shares the signals of promise, common mistakes, and lessons that matter most. A pocket guide every founder should keep close.

Over the past two years at Fusion, I’ve sat with hundreds of founders - from quick coffee chats to late-night Zooms, from polished pitches to scribbles on a napkin.Some ideas crashed just as fast as they took off, others surprised everyone and broke through..

As Israel’s most active pre-seed fund, we’ve backed 30 startups in that time. While every journey is different, I’ve started to notice certain common signals - hints of promise, mistakes that tend to repeat, and qualities that often set founders up for the challenges ahead.

Here are 7 lessons I’ve learned from those two years - all practical insights every early-stage founder should keep close.

#1 Pre-Seed Isn’t Just “Mini-Seed” Anymore

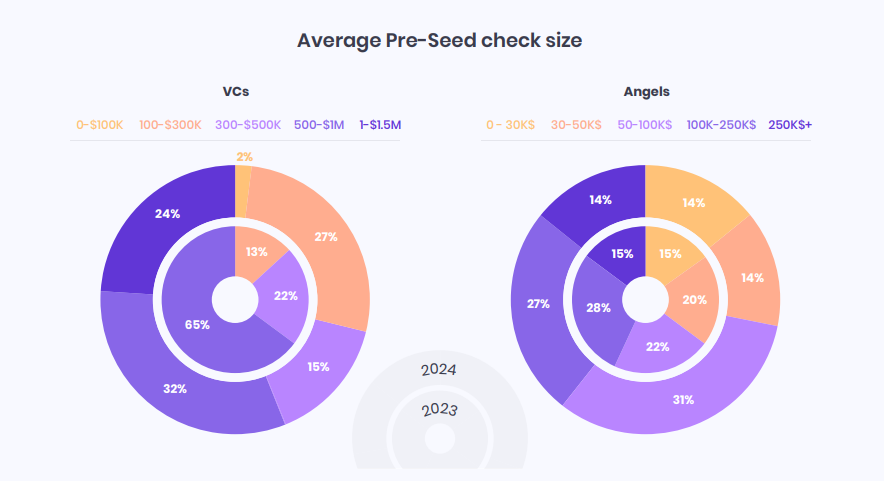

Back in 2017, when Fusion first started investing, pre-seed was barely considered a stage. It was a small check, a line on the cap table, nothing more. Fast forward to 2025, and it’s a whole category of its own. Round sizes have doubled or tripled: what once used to be $500K is now closer to $1-1.5M. At the same time, Series A investors have raised their bar and are looking for $3-4M ARR, not just $1M.

That shift has left early founders in a tricky spot: too early for Seed, too ambitious for just friends-and-family. This is exactly where we step in - helping founders validate their problem, take their first real steps in the market, and build the traction needed for the next leap..

👉 Founder Tip: When raising pre-seed, plan your runway with Series A expectations in mind. Don’t just fund the “start” - set yourself up to hit the milestones investors will demand 12–24 months down the road.

#2 Fundraising: Don’t Wait Until You’re Thirsty

One of the easiest traps founders fall into is waiting too long to raise. They think, “I’ll go out once I really need the money”. But by the time the tank is empty, it’s already too late. Investors don’t invest in desperation; they invest in momentum. Having capital in the bank shows strength. It signals that others already believe in you, and it makes it far easier for new investors to join. Money attracts money - we saw it clearly with Newlight. The moment our check went in, follow-on capital arrived much faster. Nothing fundamental had changed, except perception.

👉 Founder Tip: Don’t wait until you’re out of runway. Start raising when things are going well, so you can build momentum on your own terms.

#3 Founders > Technology

Yes, the tech matters, but at the very earliest stages the team matters more. That’s why we rarely back solo founders, and why we insist on full-time commitment from day one.

So what really makes the difference?

Chemistry: can the founders argue, disagree, and still move forward?

Humility: do they admit what they don’t know, and learn fast?

Storytelling: can they share a vision clear enough to inspire investors, employees, and customers?

Even in today’s world, where AI makes it easier than ever to spin up an early product, it can’t replace a strong founding team. We’ve seen shiny AI tools crumble without the right people behind them. And we’ve seen founders like Karny Ilan (CEO) of FeminAI, whose ability to turn a deeply personal vision into a story that resonated with investors, partners, and customers - that’s what tipped the scale.

👉 Founder Tip: Don’t rely on your tech alone. Invest in your team, your dynamics, and your storytelling. Even in the AI era, it’s people who lift a company, not just the product.

#4 The US Is the Market, Don’t Hide in Israel

It’s tempting to start close to home. In Israel, customers pick up the phone, feedback comes fast, and quick wins feel great. But that comfort can also be a trap. For global B2B or consumer products, the US is the real proving ground. It’s where scale happens - and it’s what investors expect to see. When founders spend too much time chasing validation in Israel, it’s usually a red flag.

👉 Founder Tip: Don’t get too comfortable in Israel. The only way to stress-test your product, sales cycle, and customer fit is to engage US customers from day one.

#5 Discovery Beats Decks

One of the biggest mistakes early founders make is pitching investors before they’ve truly listened to customers. Strong founders don’t start with a glossy deck, they start with questions:

Who actually controls the budget?

How do decisions really get made?

What pain is so sharp to trigger a purchase now, not “someday”?

The answers don’t live in PDFs or boardrooms, they come from dozens (or hundreds) of unglamorous conversations with the people living the problem every day. That’s where real insights hide, and that’s how markets reveal themselves.

👉 Founder Tip: Don’t treat customer calls as a checkbox. Make them the core of your process. Every discovery chat you skip today is a blind spot you’ll pay for later.

#6 Proof Changes Everything

In venture, doubt is the default. I’ve lost count of how many times I’ve heard “This can’t be done”. But nothing flips a skeptic faster than proof: an MVP, a design partner, a pilot that actually delivers - these move the needle more than a hundred slides ever could.

Ziv and Sapir, the co-founders of LeanCon, know this well. When they first pitched their AI-powered construction platform, one of the most respected executives in the industry told them flat out: “It’s Impossible”. Less than a year later, they returned with a working MVP - and that same skeptic became one of their biggest champions.

👉 Founder Tip: Don’t waste energy debating if something is possible. Build a version that works, however scrappy, and let the results speak for themselves.

#7 Choose Investors Who Do More Than Wire Money

Capital is everywhere, but not all capital is created equal. The best investors don’t just transfer funds - they transfer trust, open doors, make the intro you couldn’t land yourself, and help you skip months of cold emails.

At Fusion, we’ve seen this play out again and again: one warm connection can accelerate a startup’s trajectory more than a pile of cash ever could. Smart money isn’t just about dollars, it’s about leverage. And at the early stage, that leverage can be the difference between grinding in circles and actually breaking through.

👉 Founder Tip: When choosing investors, don’t just ask “how much are they putting in?”. Ask - “who will they pick up the phone for on my behalf?”.

Early-stage founders face fire and water. It’s messy, unpredictable, and never quite what you expect. But that’s also where the magic happens - where grit, clarity, and persistence turn the chaos into a company worth building. And from my side of the table? If it’s worth building, it’s worth investing in.