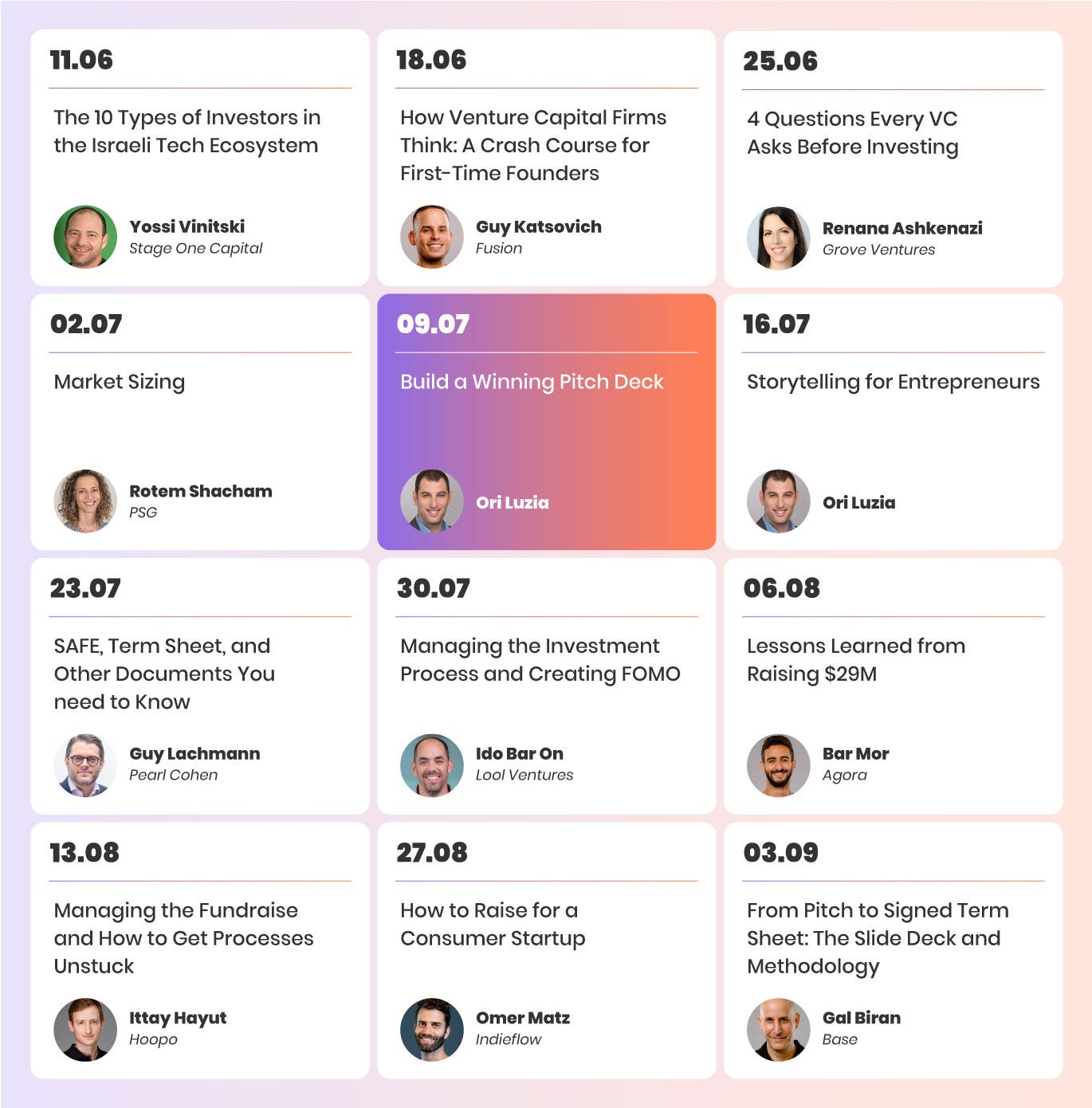

Build a Winning Pitch Deck: A Slide-by-Slide Guide with Examples

Masterclass, Episode 5: Learn what to include in your slides, and what not to include, with (many) examples to copy from

Watch the video 👇

Episode Highlights:

Love it or hate it, the pitch deck has become an inseparable part of the fundraising process. If you want investors to hear and understand your startup’s story, you’ll need to do it with some compelling slides. In this Masterclass we cover general best practices and specific, slide-by-slide examples showing you how to implement them. By the end, you’ll know exactly how to create a deck that hits hard.

What you’ll learn:

Using storytelling techniques in your pitch

The 4 questions your deck needs to answer

What to include in your slides, and what not to include

Examples to copy for each section of your presentation

Meet the expert:

Ori Luzia is a consultant and public speaking expert with vast experience working with accelerators, VC’s, and over 1000 startups in different verticals. Ori works with entrepreneurs in Israel and abroad on all things storytelling and messaging, and has helped build hundreds of pitch deck presentations.

Why Does the Deck Matter? Can You Do Without It?

It’s easy to forget that PowerPoints and slide decks are a relatively new phenomenon. Human beings have been telling stories long before these tools came into existence. As a founder, your ability to tell a compelling story shouldn't depend on the slides. You should be able to own the narrative and pitch your startup's story in any situation, with or without visual aides. You should literally be able to give your ‘elevator pitch’ in an elevator.

“The deck isn't the story; the deck helps you tell the story.”

— Ori Luzia

That being said, pitch decks have become a staple that VCs expect to see. A good deck will rarely be the factor that makes or breaks the investment decision, but it can help you get your message across and stand out from hundreds of other entrepreneurs the same VC is meeting with.

Your Pitch Deck Needs to Answer Four Questions

As you build your pitch deck, you should keep these four key questions top of mind – your slides will need to address them:

What is the market need you identified?

Which product did you develop to address that need?

How fast are you growing, and do you expect to maintain that growth rate?

Why are you the best team for the job?

This doesn't mean you have to include a specific slide dedicated to each question. Think of these as the story threads that should be woven throughout your pitch. By the end, they should be answered in a clear and satisfying manner.

Three Versions, Three Purposes: Tailoring Your Slides for the Setting

Every entrepreneur should have three versions of their pitch deck, based on where it will be used. Managing three different versions of your deck is a hassle, but it’s worth it in order to ensure you make the right impression and set yourself up for success.

Demo-day or conference

While traditional demo days are less common nowadays, conferences are a great opportunity to showcase your startup. Here you’ll need to tell the entire story in 5-10 minutes. The deck needs to be concise, snappy, and get straight to the point. You're going to be on the stage talking — the slides should complement your talk, rather than distract from it. You might need to adjust design elements like color, contrast, visuals, and font sizes for presentation in front of a large audience.

Deck sent over email

This is typically the first interaction an investor has with your company. The deck needs to be digestible within 2-5 minutes. It should be able to stand on its own since you won’t be there to talk over it. However, it’s still just a teaser for the full presentation that will happen in the meeting, so you don’t want to give everything away.

Ori notes that it’s a good idea to pay attention to details here:

“The deck you send over email is both your business card and the first impression investors have of you. Things like typos or bad design are like walking into the first meeting with a mustard stain on your shirt.”

Deck for the pitch meeting

Similar to the demo day presentation, but less flashy and more to the point. Here you have slightly more room to talk about the specifics of your technology, your team, and all the rest. In this case you’ll be speaking over the slides again, so you’ll want to reduce distracting elements. The slides shouldn’t compete with you for the investor’s attention. This version can be more flexible, allowing for optional slides and appendices that you can skip or expand on based on the dynamic in the room.

Battle-Tested Principles for Creating Impactful Slides

Minimalism: You are the star of the show, not your slides. Keep details to the bare minimum needed to get your message across. Cluttered slides create visual noise which burns through your audience’s limited reserves of attention. If you see people squinting or leaning in, it's a sign your slide could beoverly complex.

Continuity and support for the narrative: Each slide, and the deck as a whole, should form a cohesive unit. "Frankenstein" slides — where disjointed image or text elements are grafted one on top of the other — stand out in a bad way. Your story should be consistent in both narrative and design.

Internal logic: Each element of your presentation should have a reason for being there and the entire thing should have a logical progression. Pay attention to the order your slides appear in. If things don’t make sense or are referenced before being explained, this could create confusion that interrupts your flow.

”Your slides should follow the principle of Checkov’s gun: every element you include should be necessary, and unnecessary elements should be removed.”

Simple = effective: Aim for slides that can be understood in 3-5 seconds. Avoid flashy transitions and special effects that distract from your message. Choose clear and concise over cool and sophisticated.

Getting Down to Business: What to Include in Your Pitch Deck, with Examples

Most pitch decks will follow a similar flow, which you should not deviate too far from. (Differentiation should come from the content, not the structure of your presentation.)

You should keep the presentation to 8-12 slides and include any other pertinent information in appendices.

Tip: Titles are important real-estate and get more attention than other elements. You can use them to say something more than just signposting where the reader is. E.g., instead of titling your slide The Market Opportunity, you could opt for The Opportunity: A Fast-Growing and Untapped Market.

The Intro Slide

The intro slide is often treated as an afterthought, but it’s actually very important because it frames the conversation.

What to include:

Your startup's logo

A one-liner describing what you do

For conferences: Details of the CEO or presenter

The goal is to create a connection with your brand (logos, colors) and your mission. The one-liner should be descriptive – this isn’t the place for a cryptic, three-word marketing slogan. This slide helps investors ‘place’ your startup in the right mental compartment and get a feel for whether your pitch is relevant to them.

Examples

The Problem and Business Opportunity

This chapter should take up 1-4 slides. It should describe the problem space you operate in and demonstrate that there is a broad and urgent need for a solution.

This is a slide that you must get right. If the investor isn’t convinced that there is a need - you have a problem. You don’t want to get into a debate about this.

What to include:

Detail the need you've identified. Present evidence! Use research, customer feedback, and statistical data to show how big a problem this really is.

Describe the target audience for your solution.

Outline the gaps in existing solutions.

If it’s a niche that the investor may be less familiar with, you might want to also include more background information.

Examples:

The Solution or Product

This should mirror everything you described in the problem slide(s) and offer a clear explanation of how your product or service addresses the identified need.

What to include:

The bird’s-eye view of your solution.

Explain what your solution is, how it works, and the value it provides.

Include no more than 3-5 features and focus on the benefits and value of your product.

Use images to help convey your solution (including any hardware components). If you have a demo and are confident it will work, you can consider presenting it.

Don’t try to hide the reality of your product or confuse investors with aspirational features that you don’t really know how to develop. Your pitch should be transparent and accurate — both for investors to better understand your product, and to help you gain insights on ways to improve it.

Market Sizing

This slide describes the size of the market you’re operating in (investors want this to be a big number), and establishes the opportunity size for your startup in terms of TAM, SAM, and SOM. This topic is covered in great depth in our previous Masterclass: [link to Rotem Shacham’s episode]

Examples

Momentum / Traction

This section highlights your startup's success so far and how your solution has been positively received by the market.

What to include:

Show the progress you've made: This could be signed contracts, pilots, or letters of intent (LOIs) — the specifics depend on the stage your company is at.

Provide external validation: named partnerships, customers, or industry recognition.

Share examples: customer testimonials, case studies, growth metrics. Think about the story the data is telling, not just the numbers themselves. (E.g., investors love to see a ‘hockey stick’ trajectory.)

‘Big logo’ customers or partners add credibility, trust, and prestige.

The Business Model

The main purpose here is not necessarily to show a very specific roadmap, but to demonstrate that you've given serious thought to the business side (not just the tech) and have a plan for generating revenue.

What to include:

Explain potential revenue sources and strategies, even if you haven't finalized the exact approach yet.

Outline how you plan to make money: Is it through a cut from each sale, a subscription model, or something else? Avoid listing too many theoretical monetization strategies - this could signal a lack of focus or maturity.

Investors know that your business model will likely evolve over time. It's okay to admit there are aspects still being worked on or that you're mainly focusing on user engagement at the moment.

Examples

The Competitive Landscape

This is another important slide that shows investors how your startup positions itself in the market and what sets it apart from competitors.

There are two standard ways to present the competitive landscape:

Feature comparison: A table showing competitors and which features they offer versus your own solution (indicated by 'X' marks or checkmarks).

Axis-based: Plotting competitors along two specific axes that capture the essence of your competitive advantage (e.g., pricing vs. ease of use).

Investors want to see that you know who your key competitors are, and that you've selected meaningful axes or criteria that align with your value proposition and the problem you set out to solve.

Include a reasonable number of competitors, typically between 3-10. Listing too few competitors might seem unrealistic, and listing too many could be overwhelming and distracting.

Examples

Team

Investors choose to invest in a team as much as they do in the idea. Show them why your team is worth betting on.

What to include:

Highlight what makes you the ideal team for this venture: relevant experience, past successes, or unique skills that add value to the company.

- Showcase entrepreneurial pedigree, previous collaboration successes, or a track record of executing in high-pressure situations.

- Use consistent, high-quality images to create a professional impression.

- Highlight only the most relevant skills or experience and avoid walls of text.

Examples

Fundraising

Tell investors how much funding you need and what you need it for.

What to include:

How much money are you raising?

Why do you need this specific amount for?

What will you do with the funds?

Avoid using apologetic or belittling language ("we intend to..."). You want to create the sense that the train is leaving the station with or without these investors. Making confident statements (without coming across as arrogant), show investors you know where you’re going, and get them excited about joining your journey.

That a Wrap

That’s all for today! Remember to subscribe for access to the slides Ori presented in the video and high-res versions of the examples shown above. You can also listen catch the next episodes on Od Pocast.