Don't play ping-pong. Get your VC meeting with a single email

Fusion's Associate Amit Shechter shares his perspective on warm intros, cold outreach, and how to secure your first meeting with a venture capitalist (VC) for pre-seed investment

First-time founders ("first-timers") often believe that obtaining a warm introduction to an investor guarantees an immediate meeting. However, this is not the case. In my experience, only 10% of the time the immediate next step would be to ask the founder to meet.

In the remaining 90% of warm introductions, we ask the founding team to officially apply or start ping-pong and engage in a series of email exchanges before deciding whether the opportunity is compelling enough. The discrepancy is not determined by the person making the introduction but rather by how impressive the founder's initial email presenting their team and company is.

After reviewing more than 1000 applications and reading hundreds of warm/cold emails, here are a few key takeaways that you might consider when starting to approach VCs and investors.

Remember, your main goal is not to get an investment but rather to get a meeting

Venture Capital partners are getting dozens of intros and emails each day and typically would decide within half a minute if it is a team worth pushing toward the beginning of the deal-flow pipeline and ask for a meeting tomorrow or if it would be better to ask the founder to start a formal process through their website / share more information (start playing ping-pong).

Team is KING

Early-stage teams can generally be divided into three categories based on their personal and professional trajectories: Superstars, Solid, and No-Go.

Once a team is labeled as No-Go, it means game over. If the team falls into the Solid category, they must have another unfair advantage (Tech, Networking, Market understanding, etc.') to offset any personal skills or experience deficiencies. For Superstar teams, the primary concern should be avoiding "fuck ups" in the remaining portions of the email.

Here is a short template for introducing your team:

Our team has been fully committed and working on {VentureName} for the last {Number} months, spearheaded by John (CEO), and Maya (CTO). In a nutshell, John was previously {Title} at {CompanyName}, leading and responsible for {OneMainAchievement}, while Maya worked as {Title} at {CompanyName} and was responsible for {OneMainAchievement}.

Include only relevant titles and achievements that support your narrative.

If your team is not working full-time on the venture – you are not fully committed.

Including your military service/unit name is not a must, but rather a great conviction boost to your pitch.

One may ask how important the team factor is. After meeting hundreds of founders during the last year, I've formulated my scale for conviction:

Team > Problem > Market > Competitors > Solution. Nothing more, nothing less.

It is noteworthy and thought-provoking to consider the direction. I found out that the most outstanding founders opt to tackle must-have-solution problems, are also those who target correctly their ICP (market), and outplaying their most prominent competitors by focuing on execution and building a great product. These don't apply for the opposite direction.

Be VERY clear about the problem you’re solving

First, don't waste your time as the founder's time is the most expensive resource in early-stage startups (and probably at later stages as well). Second, make sure the problem you aim to solve is relevant to the investor whom you approach. For example, at Fusion we (99.9% of the time) do not invest in Cyber-Security startups.

Your main objective is to help investors share with their colleagues what problem you are solving without needing to elaborate on your solution (the broken telephone test).

The problem definition should be crystal clear and preferably take 1 – 2 sentences.

Here is another template that you might find useful:

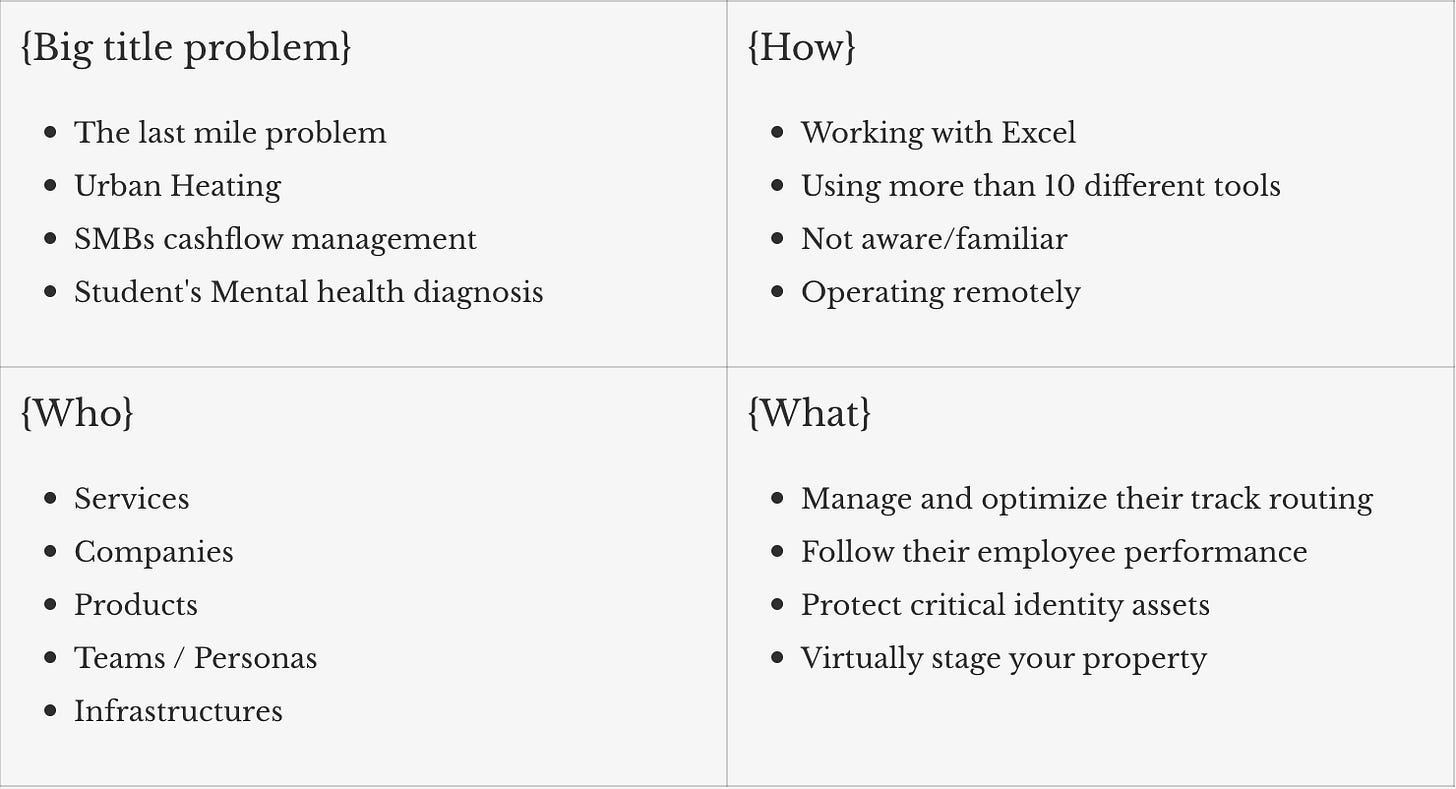

{CompanyName} focus on {BigTitleProblem}. Today, {Who} are {How} to {What}, leading to {Pain}.

Value first. Solution second.

As the famous motto of YC, "Make something people need" suggests, users, customers, and businesses are driven by values and not by products/services. They need you to fill a gap, not to build a product.

That’s why VALUE is first, and the product is second. The "shape & form" of your solution is just a means for you to provide value. Investors would usually assume you are going to pivot, and thus they care less about the solution itself but rather the disruption you aim to create.

Here is yet another template for you to consider when writing your solution:

{CompanyName} disrupts the {YourMarketName} by developing/building {ShapeOfSolution} helping {Who/ICP} achieving {What} while:

- {KeyValue 1}

- {KeyValue 2} ...

Conviction, Conviction, and… Traction

The one (and only) indication pre-seed investors have to measure their conviction and evaluate your startup is your traction. Remember – "Make something people need", and in our story (and where most people fail to understand and even more importantly, to validate), "Wow, that’s a great product! Of course I'll use it" or "That is exactly what I needed, it will solve me so many problems. I can't wait to use it", are not enough.

A real and profound validation is when they put their hand inside their pocket and pay. Even if it is only 5.99$/month for your fitness app, or 499$/month for your B2B SaaS platform. These are initial signals of conviction (traction).

If you have no traction, you should ask yourself whether it is the right time to allocate some of your time resources and reach out to investors, yet – Founder's time is more expensive than anyone else. More time on the road means higher expectations (of investors & customers) to see your execution abilities. That is why you should solely focus on getting customers, and even better, getting paying ones.

As an investment team associate who took part in more than 20 investments and watched some of these teams thrive – one of the common factors is they hustled first. While it's my perspective, I feel like it is also the unspoken truth about the Founder-Investor matching expectations problem.

From my experience, 99% of the founders who look for their pre-seed investment are expected to hustle first and generate initial traction before raising their first round. The other 1% are those Superstars, for which the investors have a sufficient conviction they will be able to generate traction with limited resources.

Here are a couple of lines I would find impressive:

As mentioned, we're running {NumberOfMonths} months, focusing on execution & getting initial traction and due to date, we have successfully onboard/sold to:

- {Number} Design Partners such as {ListOfNames}

- {Number} paid/unpaid pilots with {ListOfNames}

- {Number} of paying customers {ListOfNames} generating {Number}K$ ARR

- Converted {X} out of {Y} design-partners to paying customers generating {Z}K$ ARR.

ALWAYS end with an Action-Item

I want to try and offer a new approach. Here are my two cents. Think about offering an online meeting rather than a F2F. A short Zoom/GoogleMeet of 15-30 minutes is more than enough to understand if the process is likely to be fruitful or not while allowing more flexibility to the investor, whose schedule is already maxed out.

If this investment process is probably to end without the check in your bank account – you better know it now and not one month from now, wasting your time on 2-3 meetings and another 5-6 emails.

Make sure to include a (hyper) link to your schedule (Calendly, etc.' ) with a few options to meet, ensuring a smooth process as much as possible. Alternatively, suggest him/her to share a link to their calendar for their convenience / ask for their availability.

Here is a simple line to do so:

I would be happy to jump on a quick Zoom and discuss this further; for your convenience {here} is a link to my schedule. Alternatively, if none of them work for you, let me know what times (or link to your schedule) do, and I'll adjust my schedule and send over an invite.

One email from scheduling a meeting

Let's sum up everything we went through. Team is KING. Our problem definition should be short and crystal-clear, followed by a few sentences about your solution and (hopefully) representing your outstanding execution skills.

Here is a complete (and more concrete) example that helps as a reference to start with. I also highly recommend reading Introductions and the “forward intro email” and combining the best of both worlds. Copy-paste-friendly version below.

{IntroMakerName} – Thanks for the intro (moved to BCC to spare your inbox. {InvestorName}, it is a pleasure to connect with you.

Our team has been fully committed and working on {VentureName} for the last {Number} months, spearheaded by John (CEO, ex-UnitName), and Maya (CTO, ex-UnitName). In a nutshell, John was previously {Title} at {CompanyName}, leading and responsible for {OneMainAchievement}, while Maya worked as {Title} at {CompanyName} and was responsible for {OneMainAchievement}.

We focus on {BigTitleProblem}. Today, {Who} are {How} to {What}, leading to {Pain}. {CompanyName} disrupts the {YourMarketName} by developing/building {ShapeOfSolution} helping {Who/ICP} achieving {What} while:

- {KeyValue 1}

- {KeyValue 2}

...

As mentioned, we're running {NumberOfMonths} months, focusing on execution & getting initial traction and due to date, we have successfully onboard/sold to:

- {Number} Design Partners such as {ListOfNames}

- {Number} paid/unpaid pilots with {ListOfNames}

- {Number} of paying customers {ListOfNames} generating {Number}K$ ARR.

- Converted {X} out of {Y} design-partners to paying customers generating {Z}K$ ARR.

I would be happy to jump on a quick Zoom and discuss this further; for your convenience {here} is a link to my schedule. Alternatively, if none of them work for you, let me know what times (or link to your schedule) do, and I'll adjust my schedule and send over an invite.

If you found this article interesting, here are some other useful resources:

Now, it's time to get back to work and make these meetings happen.