Manage Your Early Stage Investment Like a Pro: From Pre-Planning to Term Sheet

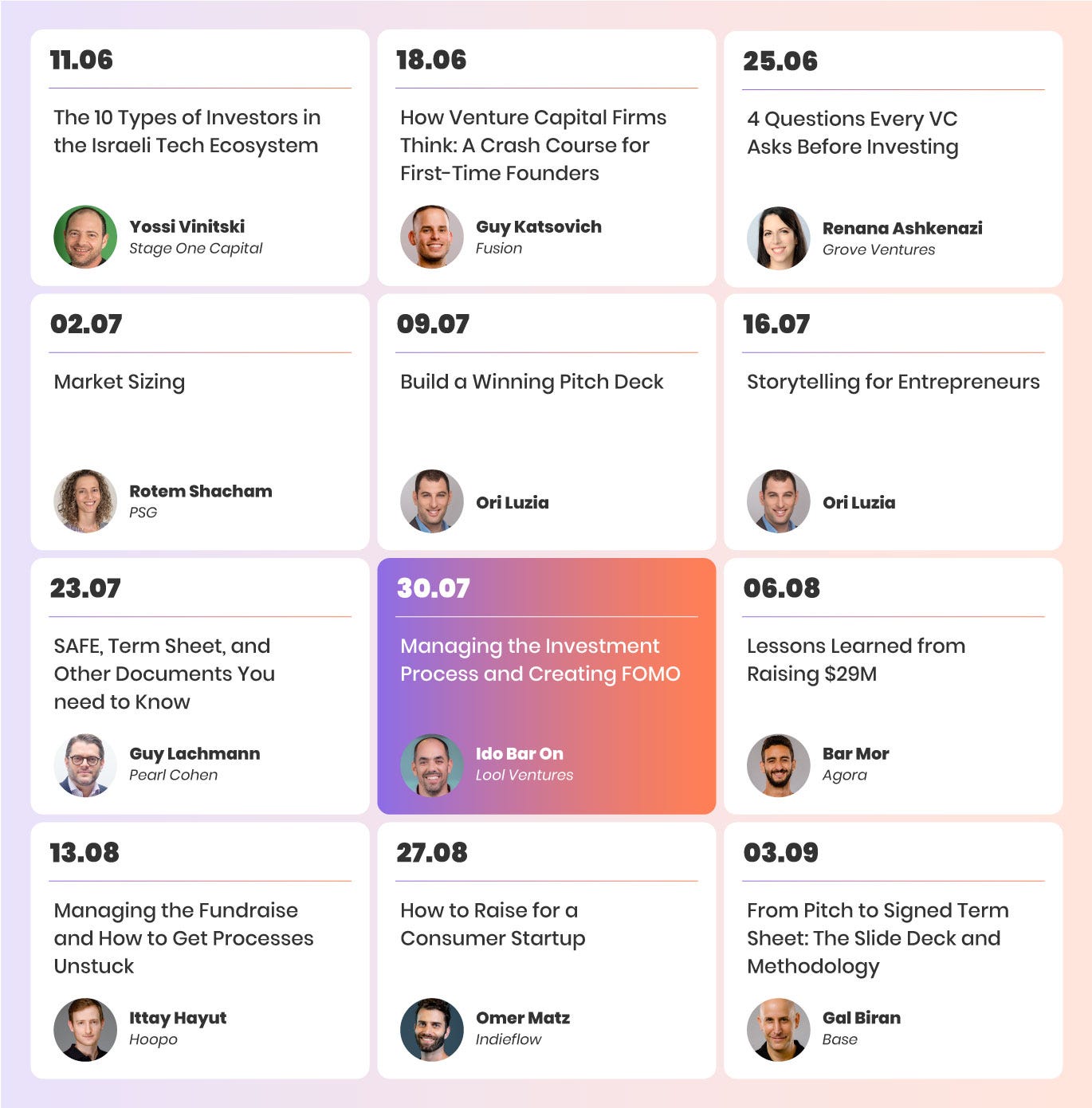

Masterclass, Episode 8: Learn how to navigate early stage funding rounds and manage negotiations with VCs

Watch the Video 👇

If you’ve already subscribed, check your email for the slides!

Episode Highlights 💡

Managing an investment round is a bit like bargaining at Shuk HaCarmel. The game plan? Trade the lowest amount of your finest fruits for a treasure chest filled to the brim with shekels. Sounds about right, no? Getting more (funding) while giving less (equity) sounds pretty simple, but as always - there are important nuances to be aware of.

This masterclass will cover what you need to know to nail the best deal during two distinct stages in your fundraising journey: pre-planning the investment round and effectively managing it once it has commenced.

What you’ll learn:

What is the goal of an investment round?

How to pre-plan your round

How to create a list of potential investors

How to negotiate better with VC about term sheets

Meet the expert:

Ido Bar-On is the VP of Business Development and Sales at XTEND, an autonomous drone startup which has raised approximately $40 million.Before his role at XTEND, Ido was an investor at Lool Ventures, where he led 13 seed investments and participated in 2 successful exits. Additionally, he was involved in 35 investment rounds at Lool Ventures.

You Have One Job: Get to the Next Round

A traditional business needs to generate more revenue than it spends to survive. Startups operate under different assumptions: You begin with an imperfect (and usually loss-making) business and continue running it until you unlock its potential by leveraging new technology, products, and networks. The core idea of VCs is to provide financial support during the initial stages of startups.

Your current investment round aims to secure enough funds for your startup to sustain itself until the next round. It will take time to determine what will happen until the next round - your business can be shut down, IPOed, or sold in the meantime - but your current goal is to ensure you have all the resources needed to get there.

What’s important in an early-stage round?

Sufficient funds: if you want to reach the next round, you’ll want to make sure you have enough runway money to keep the lights on - with some buffer. This should include the additional six months it typically takes to close the next round from the moment you start the process.

Partnering with good investors: you want to partner with investors who will support you in reaching the next round and ensure that your startup remains in good shape; And you’ll want to avoid investors who try to extract every last drop of value from you simply because you're in an early stage and they have leverage.

What’s less important?

Equity: you should’t overly stress about equity in the early stages. You can expect to give up 10-15% in a pre-seed round, and 20-40% in each subsequent round. But if you manage to significantly increase your company’s valuation, it’s usually worth it; founders with single-digit equity still tend to do well after a big exit.

Valuation: investors will assess your company's worth, and you might feel the urge to fight them tooth and nail about it, but it’s not worth it. Valuations fluctuate throughout the lifespan of a startup. If you build a fantastic company, the valuation will naturally increase; if your startup is destined to fail, a higher valuation won't help much. You just have to ensure that you align with industry norms so as not to hinder your chances for the next round.

Publicity: Building a brand is part of the game, but when it comes to investment rounds, the most important thing is money in the bank.

Pre-Plan Your Investment Round

Getting investment for your startup is a two-part process. First, you set the stage with pre-planning, nailing down the basics: your desired valuation, how much you want to raise, and who to approach. Then comes the actual round you need to manage, which involves pitching to investors, negotiating deals, and securing the funds. (This is where all that pre-planning pays off!)

How much should you raise?

When planning for an investment round, research industry benchmarks to understand what makes startups investment-worthy. For example, $1 million in ARR could be a common benchmark if you're in the SaaS business. This process involves networking and online research, considering local and global standards.

Once you know your objectives, you should secure enough funding to run your company and reach your target for the next 12-18 months, plus a six-month buffer for the next funding round. Now you can start reverse planning the funds you need to reach your goal.

For instance, To reach $1 million ARR, determine the customer mix and the required leads and calculate the cost per lead. This helps estimate your go-to-market costs. Apply this method to other areas like product development and legal expenses to estimate the necessary funding. You would probably end up with a number ranging from $1.5-2.5 million. Revisit your calculations if the figures are drastically low or high, like $300,000 or $13 million.

Finally, include a contingency in your funding plan. Always build in some extra room to ensure you have the resources to reach your goals; you don’t want to be asking for money again with your back to the wall.

When should you start raising money?

Start fundraising only when you are mission-ready – i.e., you know what you will do the day after the investment. Once investors' money is in your account, the clock starts ticking, and they'll want to see quick progress.

Before an investment round, build credibility by showcasing your potential. Achieving milestones ahead of schedule or showing steady progress can excite investors, and they may even encourage you to begin the funding round.

It's also wise to consider your connections within the venture capital world. In particular, nurturing relationships with venture capital associates, who might be better suited than partners to support you over the long term and can provide valuable insights into the optimal timing for your fundraising efforts.

Who is a good investor for you?

Remember to differentiate between the firm and the person when identifying potential investors. A prestigious VC firm may look good on your pitch deck, but it may not be the right fit if you can't spend a few hours with the partner. Conversely, some exceptional partners work at mid-tier firms and may provide a better experience.

When evaluating potential VCs, it's tempting to prioritize those who promise added value through expertise and networks. This can be an important factor, although needless to say - the ultimate responsibility for building a successful company lies with you.

How to spot the wrong investors?

Some investors aren’t right for you, even if they would be willing to write a check. To find out who to eliminate from your list, reach out to founders of unsuccessful startups within a VC's portfolio. Ask about the VC's support during challenging times and their behavior during company shutdowns.

Also, follow VC's public personas on social media (mainly Twitter), noting any negative remarks, excessive boasting, or dismissiveness towards founders. Their level of interest and expertise in your industry can also be telling.

Furthermore, understand the investor's strategy regarding direct competition. Some VCs invest in multiple same-vertical companies, while others might invest in businesses in the same industry that are not in direct competition at the moment but might become competitors through a pivot. Some remain silent about their stance. Avoid those who aren't transparent about this strategy and have open discussions with the rest to ensure you are on the same page.

Three Tiers of Potential Investors

When preparing for your investment round, organize potential VCs into three tiers:

Prime-time investors have a strong reputation and track record, and their interests can attract other investors.

Pacers, about 60-70% of VCs, help keep the process moving and provide a sanity check on pace and demands.

Last-resort investors might not have a high profile or proven track record, but can still be worth considering, as they can be leveraged in negotiations and may nudge a hesitant pacer towards a decision.

Strive for a balanced mix of these three tiers in your round to ensure momentum and a range of perspectives.

Eyes on the Prize

You’ve reached the term sheet stage! Congratulations! Consider these points as you progress:

Check size: Aiming for the highest check possible is not always the right approach. Instead, set your sight on a realistic check that leaves room for future rounds.

Equity: A mirror image of the check size. Naturally, you want to retain as much ownership of your company as possible. However, balancing equity and deal speed is also important. don't let a small percentage difference delay progress.

Commercial terms: Align with industry norms and engage a knowledgeable lawyer prioritizing closing deals over debating clauses.

Alternative cost: The best deal may not be the perfect deal. Balance the potential costs of a prolonged funding round with other aspects of your startup, and choose your battles wisely.

Squeeze that lemon: negotiations with VCs

You have progressed to final negotiations and now have to decide between two term sheets sitting in front of you. Always be sensitive to different types of 'yes' and 'no.' A 'yes' may allow for a small push for more; a 'no' could leave room for a counteroffer. Having said that, be mindful not to over-negotiate, as VCs aim to close the deal and may back out if talks drag on.

In times of need, small leverage can make a difference. A better offer from your 'last-resort' investor can help improve a mediocre offer from your 'pacer'. However, note that top-tier investors won't be swayed by less impressive offers.

To Summarize…

Your investment round begins with a planning phase where you identify potential investors who will provide a fair valuation and funding.

When managing the round, it's important to prioritize having enough funds to reach the next round and partner with investors who will support your startup's growth.

Don't worry too much about ownership or valuation, as they can change over time. Instead, align with industry standards for the terms of your deals and concentrate on building a successful company.

During negotiations, be aware of different responses, whether positive or negative, and use any advantages you have to improve the terms of your agreement.

We hope you enjoyed this episode (and if you did, we’d love if you could tell a friend). As a reminder, all episodes are also available via Od Podcast.