SAFE vs Equity: A Legal Primer for Your Funding Round

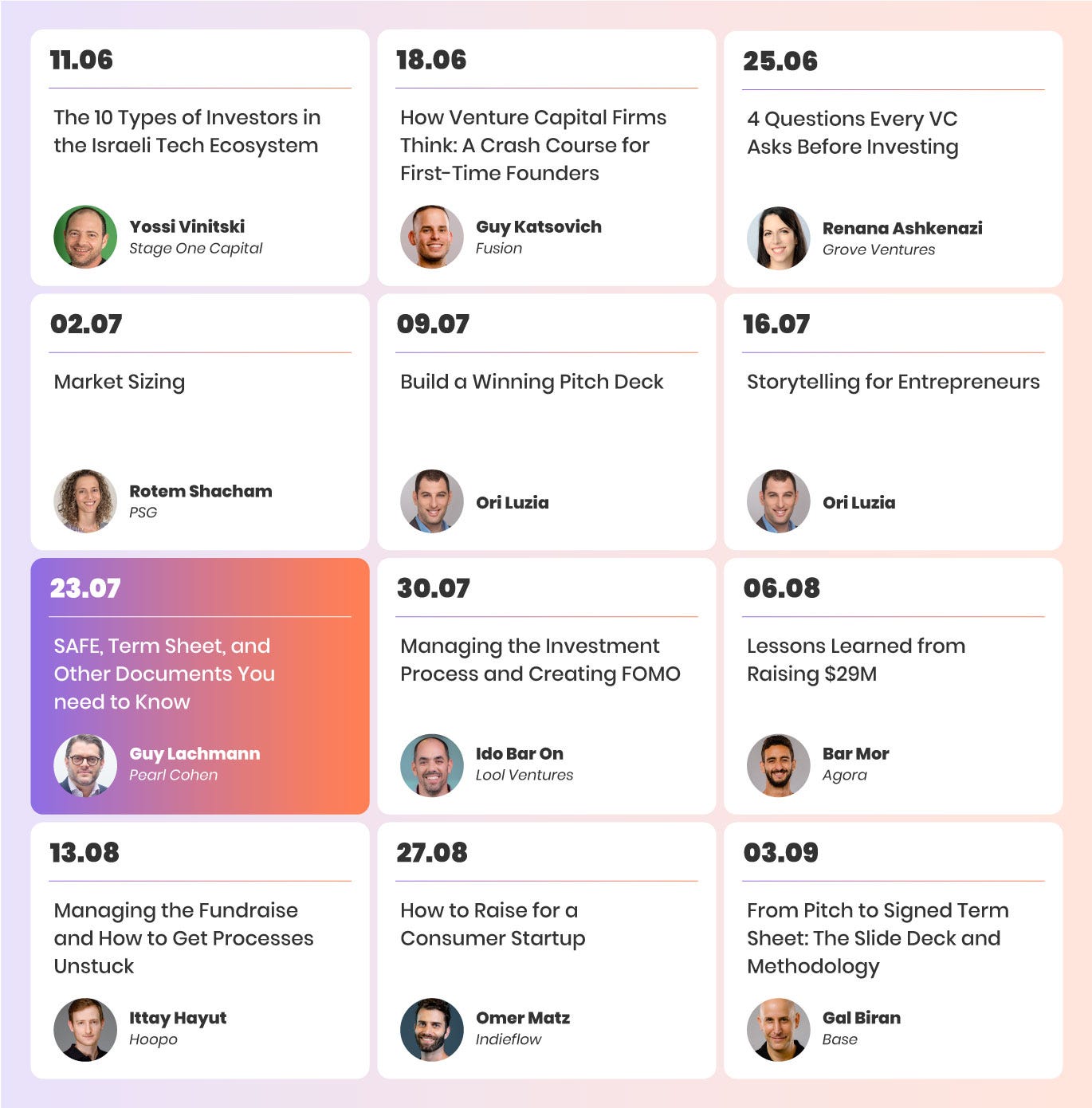

Masterclass, Episode 7: Understand the implications of different legal frameworks when dealing with investors.

Watch the Video 👇

If you’ve already subscribed, check your email for the slides!

Episode Highlights:

Navigating the legal aspects of funding rounds can feel strange and confusing. It's tempting to brush it off as mumbo jumbo or a way for lawyers to cash in. But sooner or later, you'll come face-to-face with legal aspects that you absolutely must understand in order to protect your vital interests (and those of your company).

In this Masterclass, we explain the vital role of a proficient legal team in the success of your startup. We'll dive deep into two key investment concepts: the SAFE agreement and the classic equity investment round. By the end of this session, you’ll understand the differences and implications of choosing one over the other.

(Needless to say, the following is not legal advice and is meant for educational purposes)

What you’ll learn:

What can you expect from your lawyer?

What is a SAFE agreement?

What is an equity round?

SAFE vs. equity - pros and cons

Meet the expert:

Guy Lachmann is co-chair of the high-tech group and the chair of the Japan and Germany Desks at Pearl Cohen. Guy represents entrepreneurs, investors and companies in all sectors and in various stages of their journey - including early-stage financing, traditional VC deals, debt and venture lending, combined commercial and CVC investments, M&A of all types and other exit transactions.

Legal Expectations: Working with a Lawyer

According to CB Insights, around 18% of startups fail due to regulatory or legal challenges. Competent legal representation can help you avoid this fate.

What should you expect from your lawyer?

Keep it simple - lawyers should make your life easier, not harder. They’re there to provide the legal expertise that helps you navigate the complexities of entrepreneurship. If you feel your lawyer adds unnecessary complexity, you might not be working effectively.

Consult but don’t over-consult - founders often encounter a barrage of information and “legal advice” from various sources. This can be helpful, but you should also take it with a grain of salt. When it comes to legal matters, your legal team's specialized knowledge is more applicable than generalized advice from friends and family..

Prepare for your exit from day one - founders should make sure that their lawyers are establishing a solid legal foundation from the very beginning, ensuring that their business is structured properly and all legal obligations are met. Addressing legal matters early on is essential to prevent potential hurdles during Due Diligence processes and to avoid future unpleasantness. Skipping this might come back to haunt you during later stages (up to and including exit negotiations).

Choosing the Right Type of Investment Round

One of the most critical tasks when working with lawyers is selecting the appropriate framework for investment rounds. Equity financing and SAFE agreements are two of the standard mechanisms for raising capital in startups. The following sections will detail these mechanisms and explain their advantages and disadvantages.

What is a SAFE round?

SAFE, "Simple Agreement for Future Equity," is a financial instrument developed by startup accelerator Y Combinator. The SAFE agreement provides a universal, simplified and founder-friendly alternative to traditional equity financing for early-stage startups.

With a SAFE, investors give money to the startup in return for a future promise of shares in the company. A SAFE is a convertible instrument – it’s a special form of short-term debt that converts into equity at a later date, usually at the next funding round.

The SAFE framework is employed in the Israeli startup ecosystem with a few notable modifications. If you’re raising in Israel, you can assume that the SAFE you’ll get is based on the Y Combinator features, which we will discuss shortly, but it is not a replica. You should read it carefully with your lawyer.

How a SAFE Works

Conversion scenarios

In a SAFE round, the investor's return on investment is waiting for a future date, in which the company obtains a valuation and can issue shares. These are the potential monetization scenarios:

Financing: a company raises a funding round, during which the company's valuation and share prices are set. Once the valuation has been determined, it's clear what portion of the company the SAFE investor owns.

Liquidity: in the event of an exit, such as the company being sold, the SAFE investor is treated as a regular shareholder. The investors can get their investment back, based on the conversion of SAFE to shares, or they can receive their investment back with a multiplier based on the exit value.

Dissolution: in the unfortunate event of the company shutting down, the SAFE investor is given priority in receiving any available funds for repayment.

Maturity: this is an Israeli-specific addition. A predetermined maturity date is set if the company continues its operations and generates profits without pursuing a priced round or a sale. On this date, the SAFE investor receives shares in the company proportional to their initial investment amount.

Safeguarding SAFE investors

Y Combinator aimed to incentivize investors to give startups money without receiving immediate ownership in the company. Investors would not go for this without some kind of assurance. Hence, SAFE includes four essential clauses to protect investors:

Discount: a percentage reduction on future share prices for all subsequent shareholders (which provides more favorable pricing to the SAFE investor). In Israel, the benchmark discount typically ranges from 10% to 30%, while globally it is usually 20%.

Valuation cap: a cap is placed on the company's valuation to prevent the SAFE investor from being disadvantaged in case of significant company success and soaring share prices. The SAFE investor will then receive their shares based on this predetermined cap, ensuring their investment retains its value.

Note that the SAFE investor is entitled to either the discount or the valuation cap, not both. Their shares will be allocated based on the most favorable of the two options.

A valuation cap can potentially result in considerable dilution in the future. For instance, if a company's future valuation reaches $20 million, but the valuation cap is set at $10 million, the investor essentially obtains their shares at a 50% discount and a significant dilution for existing shareholders. You should ask your lawyer to estimate the level of expected dilution before agreeing to these terms.

MFN (Most Favored Nation): this clause guarantees that the SAFE investor's rights are equal to those of any future SAFE investor. This ensures that early-stage investors are not disadvantaged compared to later-stage investors.

There are Additional provisions to grant the SAFE investor extra entitlements. These are called ‘side letter rights’ and include:

Pro-rata: in the event of an equity round, the SAFE investor has the right to participate first in purchasing shares in order to maintain their proportional ownership in the company.

Information: as SAFE investors do not hold shares (initially), they do not have a legal right to access company information. However, this clause allows them to obtain relevant information about the company's operations and progress.

Board membership: certain SAFE investors, particularly those who contribute significant funds, may request an active role as a board member to influence the company's strategic decisions and shape its overall direction.

Many founders are reluctant to grant additional rights to SAFE investors. However, these requests generally align with industry benchmarks and indicate an engaged and committed investor, so don’t storm out of the room if you hear them (but do consult with your lawyer to understand the full implications).

It’s also worth remembering that not all SAFE investors are the same. Your aunt’s $1000 investment and a $100000 check from a VC might both fall under SAFE, but obviously, the latter justifies a greater say in shaping the company’s future.

Benefits of Using a SAFE Agreement

Simple, fast, and inexpensive - using SAFE eliminates the extensive legal procedures typically involved in equity rounds, allowing for a quicker and relatively cost-effective process. From the initial draft to securing the funds in the bank, this can be accomplished within 24 hours, in contrast to the 3-6 months typically required for an equity round. Furthermore, the SAFE structure eliminates the need for extensive due diligence, resulting in cost and resource savings for the company.

No need to decide on valuation - SAFE rounds bypass (or at least defer) the need to give the company a valuation. This can often be advantageous to founders, as in the early days there is little to go by and the valuations might be lower than they’d like.

No immediate dilution - since no shares are issued, there’s no diluting impact on the cap table.

No publicity, no reflection on the financial statement - the SAFE does not appear in the company's financial reports and does not need to be publicized (because no shares are issued).

What is an Equity Round?

Another common option to raise money as a start-up is by raising an equity round, also known as a priced round. The round starts with a term sheet that assesses the company's current valuation. Based on this valuation, investors contribute funds and receive corresponding shares in return – meaning you, as a founder, will get diluted. Equity rounds come with much more legal jargon, which can be overwhelming. In the next section, we're breaking down some of the most common legal terms you're likely to encounter.

An Introduction to Equity Round Legal Terms

Ordinary vs. preferred shares

In the VC model, the "Last In, First Out" principle dictates the order of return on investments. To legally represent this concept, different types of shares are created. Common shares are the standard type, typically allocated to founders and company employees. Preferred shares are a separate class of shares that take precedence in receiving the proceeds of an exit event.

Preferred shares are often categorized based on the startup stage – Preferred A, Preferred B, etc. This classification determines the order of preference among holders of preferred shares.

Participating vs non-participating preferred

Non-participating investor: as a preferred shareholder, in the event of a company sale, an investor receives the higher of two: the original investment value or their share in the company at the time of the exit.

For example, suppose someone invested $1 million, representing 30% of the company, which is sold for $10 million. In that case, they can receive either $1 million based on their original investment or $3.33 million based on their share. a non-participating investor would receive $3.33 million.

Participating investor: in the Nachos-loving world, they affectionately call this the "double dip." In this case, the investor is entitled to both their share of the company and the return on their initial investment. First, they would receive their investment back - $1M. Then, from the remaining shared proceeds, they would get their share, an additional $3M, resulting in a total of $4 million.

Participating investors are more commonly associated with later-stage investments.

Some participating investors may negotiate for a multiplier on their investment return, such as X3 or X5, depending on the negotiation leverage of the founders.

Additional investors’ rights

The following legal terms refer to different rights that might be granted to investors during an equity round.

Preemptive rights: also referred to as pro-rata rights, these rights allow the investor to maintain their original share of the company. For instance, if the investor currently holds a 20% ownership stake and the company plans to raise another round, they are first in line to purchase additional shares in order to ensure they retain their 20% ownership.

Super-preemptive rights: with super-preemptive rights, investors gain priority in expanding their ownership stake in subsequent funding rounds. For example, suppose the investor currently owns 20% of the company. Super-preemptive rights might enable them to acquire up to 30% ownership in future rounds.

ROFR (right of first refusal) and ROFO (right of first offer): if an existing stakeholder in the company intends to sell their shares, these rights grant investors the priority to buy those shares if they are interested.

Selling scenarios

The terms we're about to dive into all deal with situations where someone from within the company, an internal stakeholder, wants to sell their shares. This can potentially pose a risk for investors, as it has the potential to alter the company's nature, and all the following clauses might be introduced in order to mitigate this risk.

Bring along/co-sale: if the majority of shareholders in a company decide to sell the company, they have the power to compel a particular shareholder who is opposed to the sale to sell their shares. The specific threshold for defining a majority varies from company to company. It's important to note that this scenario is governed by Israeli law and applies to any company in Israel, regardless of whether it is explicitly outlined in the legal documents.

Tag along: provisions that protect investors if all founders depart the company, leaving the investors behind. A ‘tag along’ clause allows investors to sell their shares when the founders sell theirs. This tends actually to occur very rarely.

Founder repurchase/reverse vesting: It’s common for founders' shares to vest over 3-4 years to keep them committed to the company. This clause stipulates that if any of the founders resign, they must return a portion of their shares. The specifics of this scenario vary significantly across different startups.

No sale + secondary: in certain cases, investors may want to prevent internal shareholders from selling their shares and can incorporate restrictions into the investment contract to achieve this, such as a 'no sale' or 'secondary' clause.

Benefits Of an Equity Round

Fixed valuation: the equity round involves a predetermined valuation for the company, providing a specific value for the investment opportunity.

Dilution and clarity: as part of the round, existing shares are diluted due to the issuance of new shares. This creates transparency and clarity regarding the ownership structure of the company.

Full-blown: the equity round represents a comprehensive and substantial funding round, often involving significant capital infusion and extensive legal and financial processes.

Summary: SAFE vs Equity Rounds

Legal abbreviations explained:

SPA - Share purchase agreement

AOA - Articled of association - charter

CLA - Convertible loan agreement

NPA - Note Purchase Agreement

SAFE has some real benefits. It saves founders loads of time and money on legal fees, plus it takes off the burden of their investors' legal expenses, usually shouldered by the founders. But the SAFE structure is best suited for early-stage or mid-stage companies as a backup plan rather than the go-to choice for rapid-growth startups. It's like a safety net, providing a flexible and straightforward financing option when traditional routes may not be too complex. Also, it is worth mentioning that VCs typically steer clear of SAFE rounds and only participate in equity rounds.

We hope you enjoyed this episode (and if you did, we’d love if you could tell a friend). As a reminder, all episodes are also available via Od Podcast.