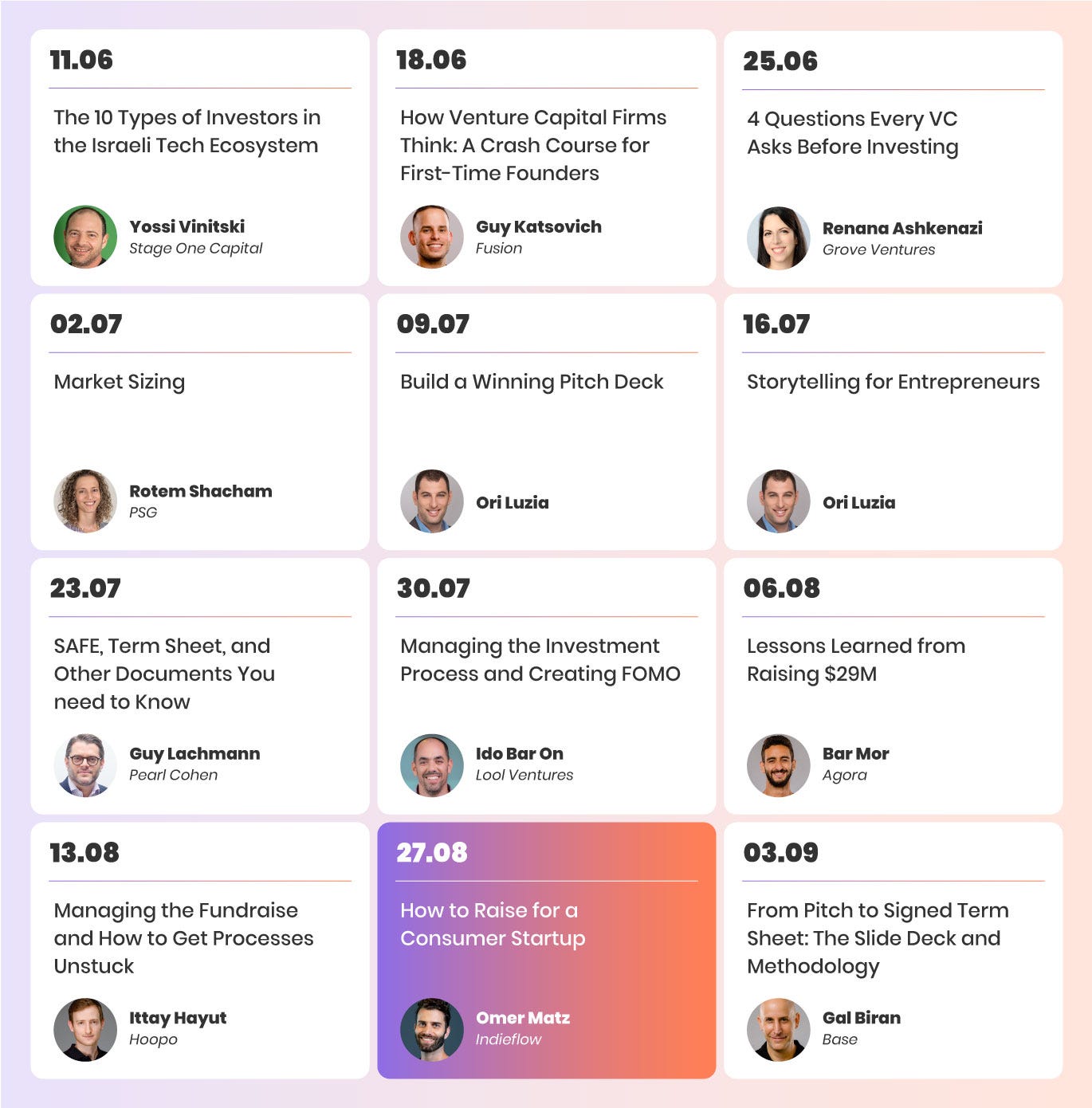

How to Raise a Seed Round When You’re Not a Cyber/B2B Startup

Masterclass, Episode #11: Learn how to fundraise for a consumer or SMB focused startup, and what to focus on to validate an early-stage idea.

Watch the episode 👇

If you’ve already subscribed, check your email for the slides!

Episode Highlights

Every founder knows this by now: once the funding round starts, you must ride the momentum. As the process of raising money begins, you and everyone around you will be entirely consumed, so you must seize any opportunity to seal the deal as soon as possible.

Omer Matz, the co-founder and CEO of IndieFlow, knows a lot about it.

IndieFlow, an all-in-one business management platform for the independent music sector, began raising money in July 2020. They secured $105K from Fusion and then worked hard for a better part of a year to raise another $450K. Then they changed strategy, invested heavily in signing artists to the platform, and by December 2021, secured a term sheet for their next round in 2-3 weeks, closing another $4M. This is despite operating in the non-conventional (for Israel) field of the creator economy, and selling a product that’s somewhere between consumer and SMB-oriented.

In this masterclass, Omer shares insights beyond the essentials. Of course, you need a pitch deck, a business plan, and a deep understanding of the market to begin talks with investors. But what comes next? What extra steps can push you over the line to close the round?

What you’ll learn:

Practical tips for preparing for your funding round meetings

Emotional tactics that will help you control and ride the funding round momentum

What you need to know when raising for a consumer product

Meet the expert:

Omer Matz is the co-founder and CEO of IndieFlow, an all-in-one business management platform for the independent music sector, who raised $6.4$ to date. Previously he was an independent musician and worked in growth and performance marketing.

Come Prepared

Mastering the market you're trying to enter and understanding the relevant investors who might assist you requires time and effort. But these are the first steps towards achieving a primary goal in your funding round: demonstrating control. Investors want to see that you command the process, not simply react to what's thrown at you. Here are some strategies to help you prepare before diving deep into your network in search of introductions:

SAFE agreement: if your round includes SAFE agreements, prepare them in advance, so you can move forward quickly if someone expresses interest. Key components to have ready are the valuation cap and discount rate.

Calendar management: plan to schedule 2-3 meetings per day over 3-4 weeks at the start of the round. This schedule ensures a sufficient volume of meetings to estimate response to your offering while allowing plenty of time to prepare yourself and your deck for each investor. These plans may shift, but strategic scheduling keeps you in control.

Don’t get caught up on valuation: be ready to avoid discussions regarding your company's valuation. This is particularly relevant for Israeli founders eager to make their mark. Instead, make it clear that the lead investor of the current round will decide the valuation and that your goal is to raise an 'X' amount of funding to gain 'Y' paying customers. Keep it simple; nothing more, nothing less.

Understand Your Ladder - Intensify Your Strengths

The Ladder of Proof is a framework developed by NFX to illustrate the checklist of metrics that investors use to evaluate startups. Each step on the ladder represents a different factor, and as a startup progresses higher up the ladder, it becomes more appealing to investors. The ladder holds truth to any funding round, though it’s worth mentioning that certain factors - like rapid growth, a strong team, or paying customers - hold more significance than others and that different VCs prioritize different aspects.

To effectively gain momentum in a funding round, familiarize yourself with all the criteria outlined in the ladder. Once you grasp the investors' perspectives, select 2-3 metrics you know you can excel at and make them your northern star for the round's duration. For example, if you form a growth background, focus on acquisition cost. If you come from a product, showcase your excellent retention rate. These metrics will be what you would showcase and improve on during the round.

You may find yourself contemplating the metrics you are not concentrating on, but do not let that confuse you. Recognizing that no organization with a small team of four or five people can excel in every aspect is fundamental to your control of the situation. Remind yourself that many startups fail primarily because of their lack of focus. Therefore, cling to your chosen metrics and do not waver.

Removing Your Investors' Skepticism – Especially in Less Typical Niches

IndieFlow is not your typical Israeli startup. It’s not a cybersecurity product launched by 8200 veterans, or a cloud infrastructure tool born out of Microsoft’s R&D center. It’s a tool for musicians built by first-time entrepreneurs who came from a business (rather than an engineering) background. To top it all off, soon after launching the company, COVID-19 struck, introducing a lot of uncertainty into the music industry.

For IndieFlow, this meant that a lot more work had to be done to find and convince investors, and this wasn’t a one-off process:

“Most of our investors today are ones who initially said no. There’s one that took 18 months to invest.”

The more generalized takeaway here is that after showing your fantastic idea and company to investors, your next big task begins: tearing down any obstacles to investment. Investors come across many ideas and startups, so you must assure them that putting their money into your venture is the right choice. How do they decide where to invest? They look for clues or indicators along the way.

First, they'll see how prepared you are with all the essential information. But you likely already know this, so let's move on.

Next, investors want to see proof of execution and progress. Those metrics you've been tracking? Now's the time to update your investors on how well you've been doing with them over the past few months. Take IndieFlow, for instance. Omer's metric for the round was marketing, while his partner focused on sales. After a few months of heavily investing in customer acquisition, they told their investors about significant growth. State of Mind Ventures - whom they had met 18 months earlier - responded with a term sheet just two weeks later.

Lastly, introducing your investors to industry experts who can explain why your approach to solving a problem makes sense can be a powerful indicator. Investors might not think to ask for this, but hearing from others about the industry can be robust, and in a crowded market, every detail counts.

(All of these things are also a way to keep in touch with investors and can be part of the virtual ‘goodie bags’ you send them, which helps keep them aware of you!)

Towards a More Varied Startup Ecosystem

If you’re launching a consumer product, or don’t fit the ‘template’ of the typical Israeli founder, there’s good news: today’s Israeli tech ecosystem is much more diverse and allows for more ideas that don’t necessarily fit the ‘template’ (this is one of our focus areas at Fusion). Still, there will be specific hurdles you need to overcome, and you might need to show more validation for your idea, and get more creative in how you pitch it.

Securing investment is a complex journey requiring maximum attention, focus, and persistence. By understanding your strengths, mastering your market, and conveying apparent confidence, you'll inspire trust in your investors. Forge ahead, and let your passion and preparation pave the way to a successful funding round.

We hope you enjoyed this episode (and if you did, we’d love if you could tell a friend). As a reminder, all episodes are also available via Od Podcast.