What We Learned From The 1,069 Startups We Didn’t Invest In 2024?

Fusion's Associate Amit Shechter shares his perspective on lessons learned from 1069 teams we’ve met and unfortunately didn’t invest in 2024.

2024 was a busy year at Fusion: we made 22 new pre-seed investments. But let’s shift the spotlight for a moment. What about the 1,069 startups we didn’t invest in? What are they working on, how much have they raised, and why did we ultimately say "no"?

In venture capital, reports typically focus on the successes—fundraising milestones, acquisitions, and exits. But there’s an equally important, often underexplored side to this industry: the startups still on their fundraising journey. Understanding their challenges, sectors, and team dynamics can offer valuable insights—not just for investors, but for the entire ecosystem.

Breaking Down the Numbers

This year, we evaluated 1,091 startups. Of those, 763 teams formally applied through our website to join Fusion’s 2024 program. The remaining 328 teams came from other channels:

114 teams came via warm intros,

156 reached out cold via email, and

58 were teams we proactively approached. (Yes, investors do reach out to founders too!)

So, What Are These Teams Building?

Unsurprisingly, AI leads the pack (120 teams, 15.8%) working in this space. Next up is Digital Health (65 teams, 8.6%), followed by familiar favorites like Enterprise SaaS/Vertical SaaS (46 teams, 6.1%), FinTech (46 teams, 6%), and Gaming (35 teams, 4.6%).

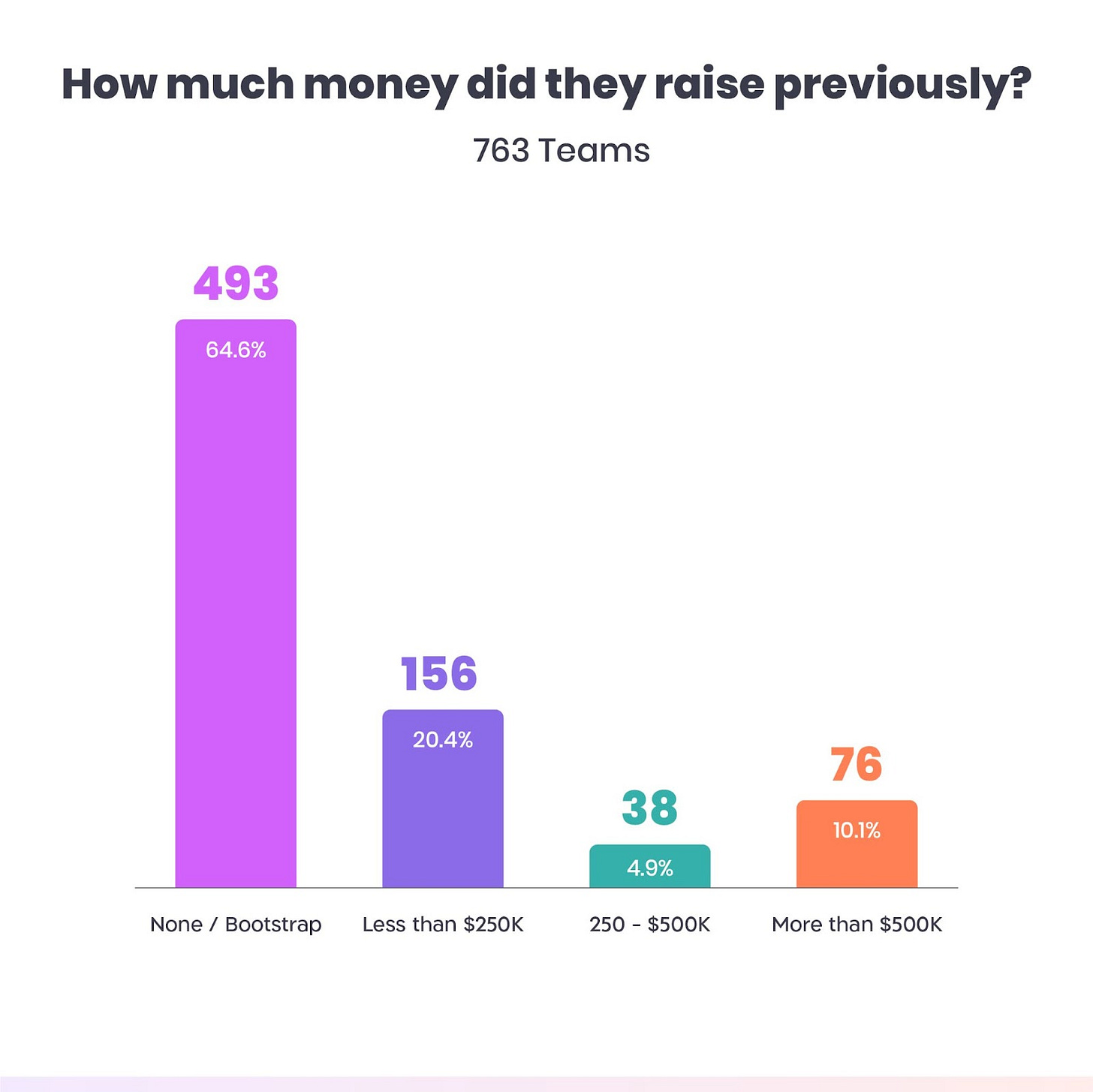

How Much Have They Raised?

Most teams we met (493, 64.6%) came to us without any prior funding. However:

156 teams (20.4%) raised small funding (tens to hundreds of thousands of $’s).

38 teams (4.9%) raised between $250K and $500K.

10% (1 out of every 10) of the teams we’ve met had raised over $500K before our meeting, often from angels, incubators, or other funds.

Were we surprised? Not really, but we’ll discuss this later.

What Did We Learn from the Data (and the Lessons Hidden in What’s Missing)?

“AI-powered” VS. Core-AI

First and Foremost – the real insights lie beneath the surface (and we’ll delve deeper into them in the coming months when we publish our annual Pre-Seed Report.), but while nearly 16% (1 in 6) of the startups we met has identified as "AI-focused," a deeper dive revealed that only 12 teams (out of 120) were working on what we’d consider deep/core tech AI (e.g., data infrastructure, hardware, cloud). The other 108 teams were building what we call "AI-wrapped products"—tools or platforms with yet another (sometimes cliche) one-liner starting with “AI-powered.” This raises critical questions: Can the market absorb all these AI-driven solutions? Or will many struggle to secure follow-on funding and market adoption?

We’re leaning toward the latter. In fact, we believe that much of the current excitement around AI is fueled by FOMO—organizations rushing to adopt AI solutions out of fear of being left behind, rather than because they genuinely need them.

This trend is one of the main reasons we’re cautious about investing in the space. Founders need to set themselves apart, either by building a unique moat or showcasing an undeniable founder-market fit. And right now, that’s tough to do given the noise in the market:

On the supply side: The barrier to building applications, platforms, and solutions has become almost non-existent. In some cases, it’s as simple as stringing together a few well-crafted prompts.

On the demand side: The real money for AI solutions is concentrated in a handful of verticals—Sales, Support, and Finance—where budgets are significant. Other areas like HR, Legal, and Product? They often have smaller budgets for their tech stacks, making it harder to justify adoption.

In short, when ROI and metrics are crystal clear, adoption follows, and so does the money—from both investors and customers. The rest? Well, let’s just say they’re in for a tough ride.

Not every founder is an 8200 that raises multi-million dollar rounds on a presentation

In less common and non-obvious sectors, the ability to move quickly with limited resources—often bootstrapped with no external funding—becomes crucial. The formula? Build an initial product that tests fundamental hypotheses and, most importantly, proves them. This proof can come from different metrics such as user engagement, active customers, early sales, or other KPIs.

Why does this matter? Because this proof alongside the ability to craft a compelling narrative and manage a fundraising process, will ultimately determine a founder's success towards securing follow-on funding. So, what matters less?

Polished pitch decks.

Fixating on terms like dilution or deal structures (which often adjust over time).

“Advisors” who don’t deliver real value.

And what matters most? Execution.

Not all markets or teams were born equal. Not every founder is an 81/8200 alum launching a cybersecurity startup that raises $12 million on a presentation. For many, the journey is different, and to be honest much (much) more challenging. They’ll need to navigate a strategic pre-seed round—often broken into several smaller sub-rounds—to secure somewhere between 6-18 months of runway before reaching the seed stage.

It’s not an easy path, but for those who can prove their worth through action, the rewards are well worth it.

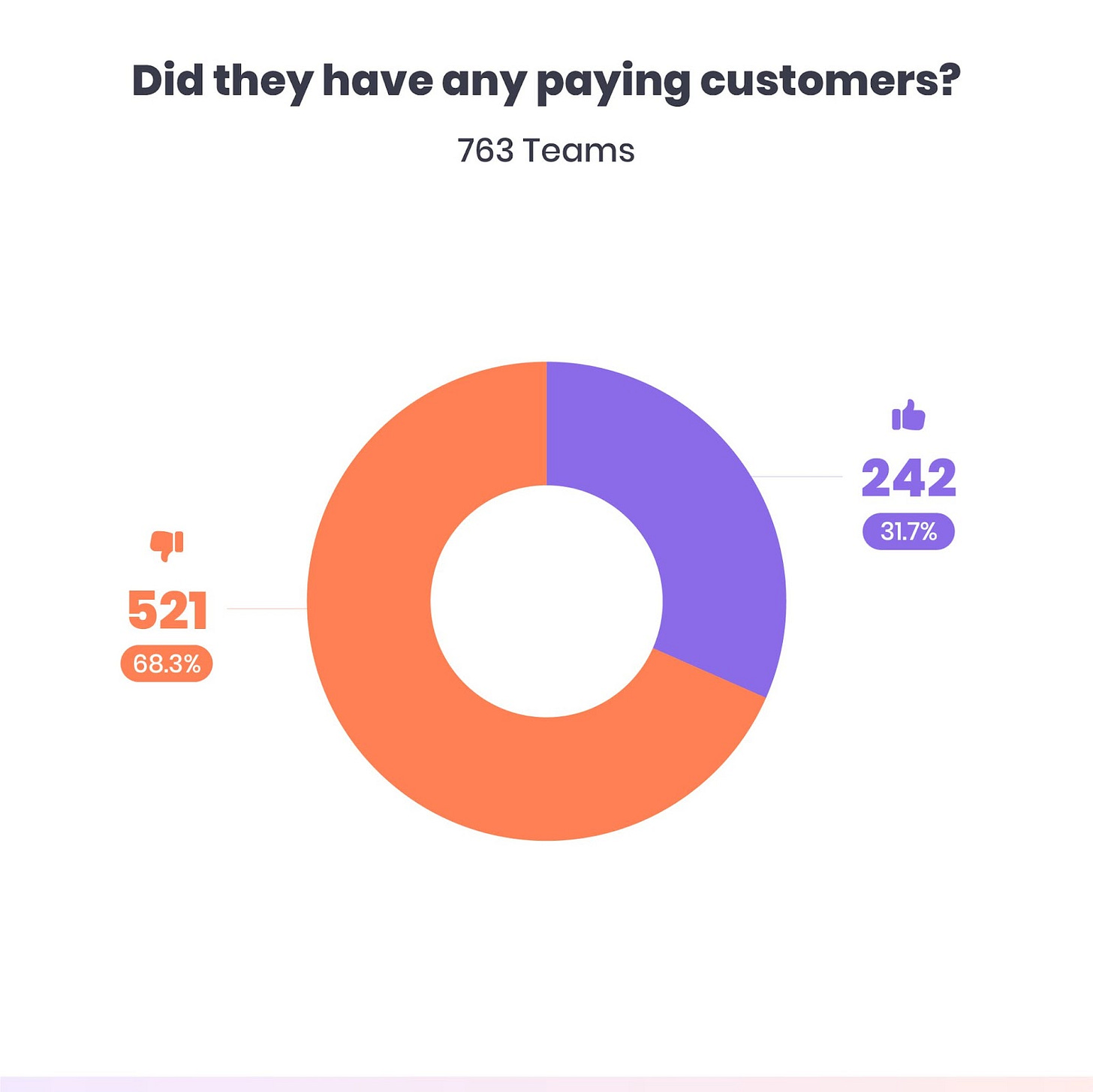

Revenue ≠ Validation

We’ve noticed a significant growth in the number of teams generating initial revenues in the tens (or even hundreds) of thousands of dollars within just weeks of launching their product. Undeniably impressive.

However, when we dig deeper and ask for metrics and KPIs, the picture becomes less rosy—or, more accurately, customer churn data tells a different story. It’s easy to mistake early validation as being solely about traction and sales. But the reality is far more complex.

Here are some of what we consider red flags that lead to why we often choose not to invest:

The sales didn’t come from the right ICP (Ideal Customer Profile).

Selling to Israeli organizations isn’t indicative of the team’s ability to sell in the U.S. market, which is often fundamentally different. We can not stress enough how common it is to see that slide in a pitch deck featuring a collection of (IL) Blue-White logos of “customers.” All too often, these are pilots that were set up with the help of friends from the army or a previous workplace—and they rarely reflect true market validation.

The company doesn’t fit the venture capital model. While it might be an incredible business generating millions in annual revenue, it’s unlikely to scale into the kind of company that delivers returns for our LPs.

Validation goes beyond impressive numbers—it’s about proving that the business can sustain and scale in the right market with the right customers. For us, that’s the defining factor.

Hardware Startups: Two Paths, One Clear Winner

When it comes to hardware startups, we’ve noticed two distinct categories emerging from the teams we’ve met.

The first category? Consumer-focused products designed to sell directly to customers (D2C) or through similar channels. Here’s the reality: out of thousands of startups we’ve evaluated, we’ve invested in exactly one D2C company. Why? Because most simply aren’t a fit for the venture capital model. These teams often struggle to achieve meaningful sales (think tens or hundreds of millions of dollars within 6-10 years) while operating with limited resources. And even when they do, raising follow-on funding tends to be a massive hurdle.

The second category, and the one we find much more exciting, revolves around deep technology. This is where we see hardware startups shine. Founders in this space often come with rich backgrounds—whether from academia, military service, defense industries, or top-tier companies. This level of expertise stands in stark contrast to many software startups, where domain experience is often less critical.

At Fusion, we weigh founder experience heavily when evaluating hardware and robotics startups. These industries demand unique access to specialized knowledge, talent, and networks of customers and investors. It’s no surprise, then, that we’re seeing more exceptional teams gravitate toward this space. The shift is clear in our numbers: in 2023, we didn’t make a single hardware investment. This year? Six(!) and not one of them was in a D2C product. Instead, these investments were in startups combining deep technology, advanced algorithms, and clear, scalable business use cases. Many of these teams are rooted in academic research or cutting-edge knowledge gained during military service.

The trends we see here mirror what’s happening in Silicon Valley (Tesla’s Optimus and many more..), with a growing intersection of artificial intelligence, hardware, and robotics shaping the future of industries far beyond tech.

This shift is driving innovation across the physical world: from construction and factory infrastructure to supply chain solutions like packaging plants, asset management, shipping, and aviation.

EQ & Meta-Behavior

At Fusion, one of the most important factors we evaluate is whether the founder sitting across is feedback-sensitive. To be honest, this is often the reason why some teams don’t make it past the first meeting.

We want to see founders who can read the room—and, more importantly, adjust accordingly. For us, this is a critical component of a team’s entrepreneurial DNA. Far too often, we meet teams where the CEO is more focused on delivering a pitch than engaging in a dialogue. They answer questions only after finishing their prepared slide, prioritizing the points they want to share rather than addressing what we’re actually asking.

Our advice, which we also share with our alumni? Lean back, listen, and stay flexible. Be open to steering the conversation in directions that may feel less comfortable or stray from your rehearsed plan.

What we call "meta-behavior" often manifests in subtle yet powerful ways: language, communication style, honesty, and transparency. These qualities don’t always show up in a pitch deck or metrics, but they are crucial for building trust and strong relationships—with investors and, even more importantly, with customers (especially those early adopters). After all, in the early days, it’s the founders themselves—not a sales team—who drive the critical sales processes.

To us, entrepreneurial leadership isn’t just about technological innovation or marketing prowess. It’s about the ability to listen, recognize opportunities, make necessary adjustments quickly and wisely, and steer the ship toward its ultimate destination.

Now, it's time for all of us to get back to work & hope for a better year to come