Market Sizing: Make Assumptions But Don’t Make S@##! Up

Masterclass, Episode 4: Learn how to realistically assess your target addressable market (TAM), and what investors expect to hear

Watch the Video 👇

Episode Highlights

Most entrepreneurs can recite the three Ts that make or break a startup – team, tech, and TAM. But they tend to spend a lot of time thinking about the first two, and treat the third as a technicality. Do a quick Google, find a big number to slap on a slide, and call it a day.

This is a mistake that’s hurting your chances with VCs. As we’ll see below, market sizing matters a lot to investors, and there are best practices you should follow to come up with a realistic estimation. Read on for the VC perspective; for serial entrepreneur’s take on the same topic, see our previous article on product/market fit.

What you’ll learn:

What is market sizing

TAM vs SAM vs SOM

Best practices in sizing your market

Pitfalls to avoid

Meet the expert:

Rotem Shacham is a Director at PSG, an American growth equity fund that invests in Israeli startups. Previously, Rotem was a Principal at Viola Ventures, and a consultant at the Boston Consulting Group.

What is Market Sizing? What’s a TAM?

Your total addressable market (TAM) is an estimation of the total sales you could achieve within a specific target market, assuming you were able to capture 100% of it. E.g., if you're launching a gluten-free snack subscription box service in North America, your TAM would be the total amount that North American consumers are willing to spend on gluten-free snacks. The process of estimating your TAM is called market sizing. Investors use this information to assess whether your startup has an opportunity for substantial growth and profitability.

TAM? SAM? SOM?

You might have come across a few other acronyms, and some VCs might ask you about them. Let’s take a quick dive into the alphabet soup:

TAM: This is the total addressable market, as described above.

SAM: The serviceable available market – a subset of the TAM that you realistically can serve or address, taking into account that not everyone in the TAM will buy from you.

SOM: The serviceable obtainable market – an even smaller subset, referring to the portion of the SAM you can realistically capture in a given timeframe, taking into account your marketing and sales efforts, competitor landscape, and other factors.

Different VCs have different approaches, but Rotem says she doesn’t think entrepreneurs should bother with these granularities. “You’re just adding more and more layers of assumptions and hypotheticals”, she says. “And every one of these is something that VCs will try to challenge you on. At the end of the day, these estimates don’t mean much. Your startup is going to change radically throughout the years anyway.”

Why Market Sizing Matters to Investors

We’ve mentioned the three Ts that investors are looking for: team, tech, and TAM. Rotem mentions that especially at early stages, TAM is a much more concrete and grounded criterion compared to the other two. Everyone says they’re looking for a “winning team” or “A players”, but no one can actually tell you what this means in objective terms. As for technology and product, these tend to be more of a vague idea at seed and pre-seed stages, and either way most startups are likely to pivot more than once in their lifetime.

TAM has several advantages: It usually doesn’t change dramatically from year to year. It’s objective and can be determined based on facts, rather than biases about what a team of A players looks like. It’s not dependent on the startup releasing a certain feature by a certain time. And it’s at least partially predictable based on historical data (such as CAGR, which we’ll cover below).

Bottom line: TAM matters a lot to investors, and you should make a serious attempt to size your market before pitching to them.

Go Big or Go Home

Your TAM needs to be large. This isn’t just a slide deck consideration but something that you should stay focused at the ideation stage.

Investors are looking to invest in companies that can get big enough to justify big exits. Valuations are based on current earnings and future estimated earnings. If your target market caps out at $300 million, you’re never going to build a billion dollar company. A hyper-specific segment is an impenetrable glass ceiling.

How big is big? Rotem says that a good market size benchmark would be somewhere between $1-2 billion, depending on who you ask. And of course, it needs to be a market that’s growing rather than shrinking (more on this later).

It’s not about reaching the “correct” answer. You’re trying to reach an informed, reasonable estimate that’s backed by logical and explainable assumptions – not an in-depth analysis that would withstand scientific scrutiny.

Two Ways of Calculating TAM - An Example

Let’s say your startup is building an app that automates reporting for contractors in the construction industry. What’s your TAM? There are two ways to reach that answer:

Top-down approach

Start with the overall size of the construction market. You can use previous research for this, as we’ll explain below.

Determine the share of revenue spent on IT within that market.

Out of the total IT spend, identify the percentage spent on application software.

Calculate the relevant percentage from the total and there’s your TAM.

To estimate future market size, look at historical compound annual growth rate (CAGR), and make the necessary multiplications. You might need to adjust your assumptions if, e.g., you think that IT spend will increase during this period.

Bottom-up approach

Determine the average amount you expect a contractor to pay for your application

Identify the total number of contractors in your target market (e.g., the US)

Estimate your expected penetration rate - the percentage of contractors who would use your app

Multiply these figures together to estimate your potential market size

Two notes on this:

We’re not doing any kind of advanced calculus. It’s just multiplying and dividing numbers.

In early stage fundraising, top down might be more reliable than bottom up. This flips later when you already have data about how well your product is selling, how much customers are willing to pay, etc.

You should do both calculations, and reach numbers that are in the same ballpark. If the two figures are radically different, you’ve gone wrong somewhere.

How to Size Your Market: 6 Best Practices

1. Make assumptions and stress them

In an ideal world, you could go to some perfectly accurate database and pull the exact figures you need to size your market. In reality, you’re going to have incomplete data and will need to make assumptions and educated guesses. That’s absolutely fine as long as your assumptions make sense and you show your work.

Stress-test your assumptions with a sensitivity analysis. Test the effect of changes in the input values on the TAM figure. This helps you understand the reliability and stability of your estimations, and to identify the boundaries within which your market sizing makes sense. If we go back to our ConTech example, you had to make some assumptions about how much contractors would pay for your app and how many of them would use it. What happens if you use more pessimistic numbers? What’s the margin of error that would still leave you with a decent opportunity size?

2. Leverage existing research

Google is your friend. You’ll be surprised at the amount of public information available about industries and markets. Find industry research and whitepapers that have already done the work for you. Use your judgement here, since there are plenty of garbage reports out there. Cross-referencing multiple sources is a good idea.

Sometimes the exact information won’t be readily available, especially for niche markets or emerging technologies. In these cases, you should find data about similar markets or products, and try to derive your numbers from there.

3. Triangulate different sources and methodologies

This goes back to using more than one source and more than one methodology to size your market. Try to make different assumptions or to reach the same conclusions from a different direction. Does your analysis still stand?

The assumptions you make need to be defensible, and the end results should be grounded and reasonable. Pitch decks often throw around market sizes in the trillions of dollars - very few markets are actually ever going to reach this level. Stay cognizant of potential outliers and view your estimations with a critical eye.

4. Look for directional rather than specific figures

The details matter less than you think, so don’t get too caught up in the nitty-gritty. Whether your market is worth $2.5 billion or $2.7 billion doesn't make a huge difference, and you’ll rarely have data that’s accurate enough to really determine this. What matters is to convince investors that there is an opportunity, that it’s growing, and that you have a reasonable chance of capturing it.

5. Consider the future outlook and trends

VCs aren’t investing in the five-person startup you have today. They’re investing in the idea that you will be a 1000 person mega-company in ten years from now. For that to happen, your market sizing needs to stay relevant over the long term. (The fax machine market was still very big fifteen years ago…) Try to account for emerging trends, changes in consumer behavior, and potential threats.

6. If you can’t find data, that might be a good sign

If you can't find data specific to your niche or industry, don't panic! In fact, this could be a signal that you’re onto something new and unique. When data on your target market is scarce, turn to similar industries or adjacent markets, and use that as a starting point. Here too, stay within the confines of logic. Avoid assuming massive changes in technology usage patterns over the course of a few years.

Common Mistakes and Pitfalls to Avoid

1. Wrong market

Probably the most common mistake entrepreneurs make is claiming to serve a massive market when in reality their solution addresses a tiny part of it. Yes, you want the number to be big, but it also needs to make sense. Looking at a parent category instead of the field you’re actually playing in will not convince anyone.

For example, if you're developing a recommendation algorithm for e-commerce companies, you can't count the entire e-commerce market as your TAM – you’re not selling the clothes and beds that people buy online, you’re selling software. In industries such as cybersecurity and DevOps, startups are often serving a 'derivative of a derivative’ (e.g., financial services companies using AWS or Azure)..

2. Overly optimistic assumptions

If your analysis hinges on wildly optimistic assumptions about adoption, growth, or price, you’re going to crash against reality sooner or later. It's fine to start from an optimistic viewpoint, but be prepared to answer questions about less rosy scenarios. What if the market doesn’t keep growing at double-digit CAGR for the next decade? What if customers aren’t willing to pay a premium for the software you’re selling?

3. Ignoring potential market disruptors

Entrepreneurs tend to overestimate the impact of their own software, and underestimate the effect of other new technologies, trends, or market changes on their TAM. Stay informed about industry trends and market shifts, even those that may initially seem unrelated to your product. Don't dismiss potential negatives as unlikely; instead, plan for and acknowledge these possibilities when calculating your TAM.

Final Thoughts

Market sizing might seem daunting, but most of it is based on common sense and publicly available data. It’s all about striking a balance between telling an optimistic story about the opportunity size, without falling into traps of trying to sell investors on baseless assumptions or unrealistic projections.

Follow the best practices we described above, stay grounded, and be prepared to defend your assumptions – and you should be able to cross this hurdle without much difficulty.

Key Takeaways

Market sizing is crucial for assessing a startup's growth potential, and investors pay close attention to it.

A good benchmark for a market size is around $1-2 billion + a market that’s growing YoY.

Use top-down and bottom-up approaches to calculate TAM, and make sure the numbers from both methods are in the same range.

When sizing your market, make reasonable assumptions, leverage existing research, triangulate sources and methodologies, focus on directional figures, and consider future outlook and trends.

Avoid mistakes like zeroing in on the wrong market segment, making overly optimistic assumptions, and ignoring potential market disruptors.

Following market sizing best practices, staying grounded, and being prepared to defend your assumptions can help convince investors of your startup's potential for growth.

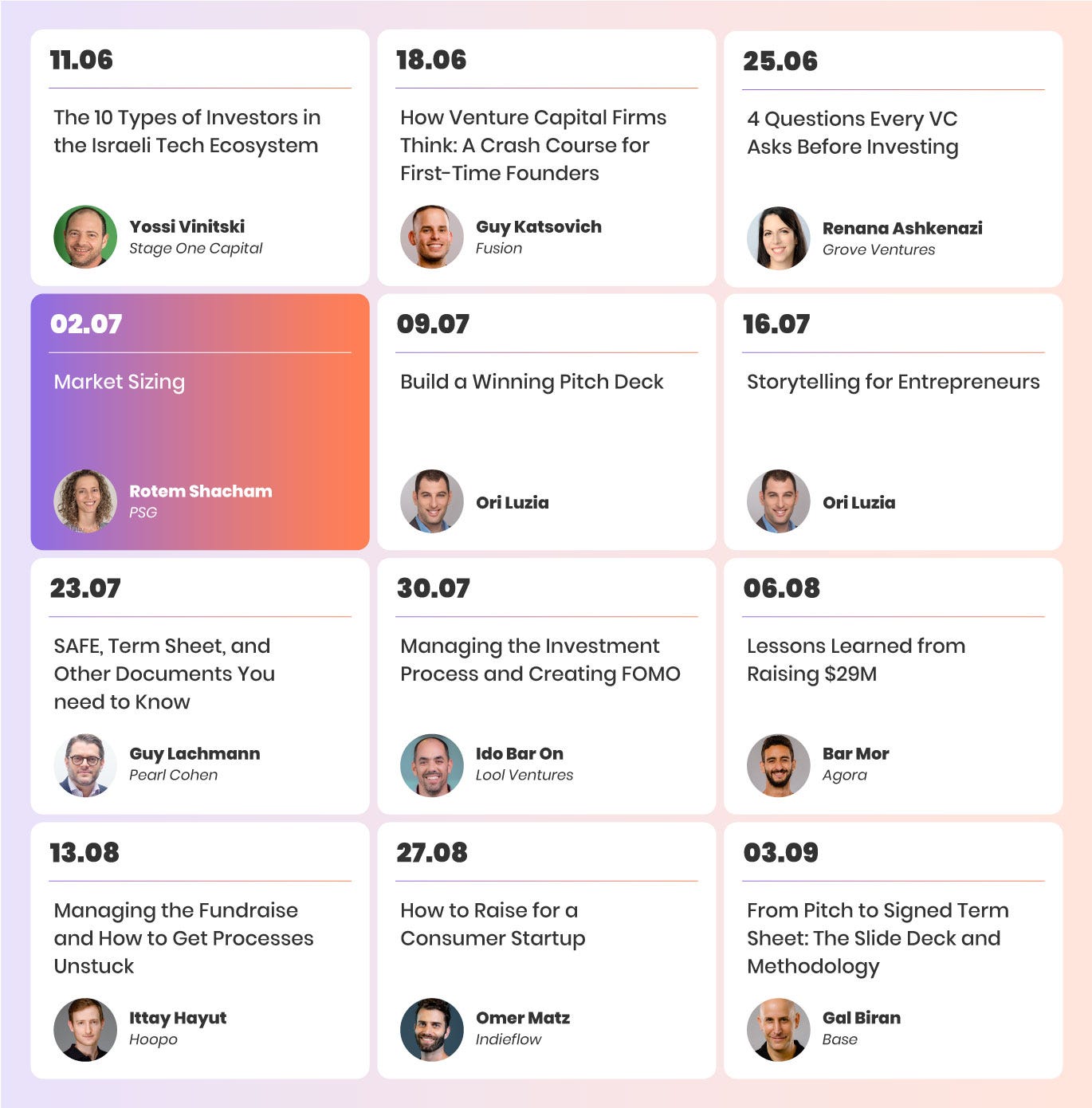

Stay tuned for next week’s episode, where we’ll cover best practices in preparing your slide deck (subscribe to get it before everyone else). As a reminder, an audio version of all episodes is also available on Od Podcast.