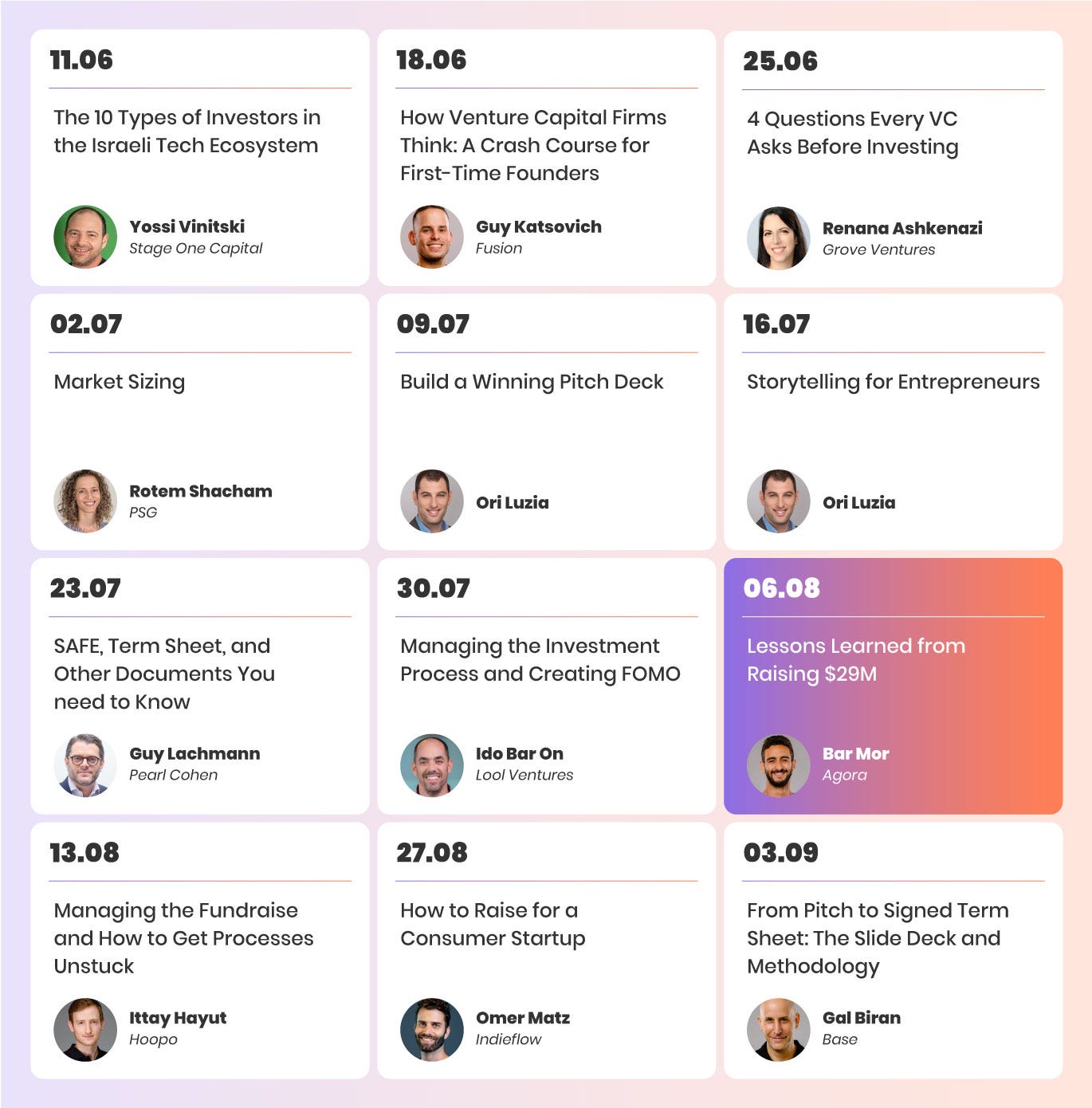

Startup Stories: The Tactics and Pivots Behind Agora’s $29M Funding Win

Masterclass, Episode 9: a detailed look at an actual startup’s journey from inception to Series A - and the lessons learned along the way.

Watch the Video 👇

If you’ve already subscribed, check your email for the slides!

Episode Highlights 💡

Bar Mor, co-founder of Agora—a real estate investment management platform—has led his company to raise a total of $29M in its Series A. Today he manages a fast-growing team of 70 employees and two offices in Tel Aviv and New York City. In this Masterclass, Bar offers an insider's perspective on Agora's journey and the valuable lessons learned at every stage.

What you’ll learn:

A detailed look at an actual startup’s journey from inception to Series A.

Key insights for each stage of a startup's development.

Meet the expert:

Bar Mor is the co-founder and CEO of Agora, a real estate investment management platform that raised $29M to date. Before founding Agora, Bar was a team leader in Unit 8200..

Early Ideation Days: How A Startup is Born

In the spring of 2018, army friends Bar Mor and Lior Dolinski joined forces and started their own company. Bar's family was in real estate, so they figured that could be their starting point.

"We jumped right in," Bar remembers. "We wanted to learn everything possible." So, for the next six months, they dug into everything they could find about the field. They looked at other businesses, studied different business models, listened to podcasts and took online courses. All this learning led them to an initial idea: using blockchain to build a place for handling real estate investments.

Bar and Lior started to talk to friends, family, and anyone willing to invest in their dream. By October 2018, their hard work paid off: they raised $300,000. This was the starting point for Agora.

"The key reason we were able to get people to invest was our deep understanding of the field and ability to engage in insightful conversations about the industry."

Key takeaway: Domain expertise is king. Showing in-depth knowledge of your field helps early investors trust you with their money.

The Pivot: Blockchain → SaaS Platform

Bar and Lior began to roll out their idea. But by April 2019, six months after their initial fundraise, they realized a pivot was necessary. While blockchain was the talk of the town, building the product around it began to seem like a hindrance rather than an advantage.

Bar recalls, "We drafted a document outlining nine potential directions for the company. We then began talking to people, gradually ruling out options."

By September 2019, they had honed in on a single concept: a SaaS platform for managing real estate investments. Armed with this finely-tuned vision, they returned to their initial investors and successfully secured an additional $200,000 in funding.

Key takeaway: Choose the one idea that not only holds the greatest potential for success but also poses the least obstacles.

Building and Validating

With fresh funding and a clear direction, it was time to take Agora’s product to the next level. Noam Kahan, a friend of the founders, was brought on board as CTO. They kickstarted product development by leveraging cost-effective offshore developers. The primary goal at this stage was to bring a basic version of their product to market quickly.

While building the product, Agora wasted no time and already began establishing relationships with potential customers. They launched their pre-seed round with four committed customers, $80K in ARR, and another four potential customers lined up. Their clientele ranged from a $50M fund to a firm managing over $1B in investments. With these promising figures, Agora successfully raised an additional $500K in their pre-seed round (in which Fusion VC was an investor), bringing their total investment to $1M.

Bar advises treating initial funding rounds like a sales funnel. Create a tiered list of potential investors, then thoroughly document all interactions, introductions, and timelines. This approach helps ensure you engage with the most relevant individuals. (We’ll cover this process in more depth in future episodes - stay tuned!)

Key takeaway: Ideas are easy to find; the market for execution is smaller, and the market for good execution is even smaller. Show investors tangible proof that you’re executing on the product side, rather than just burning through cash.

Going Big: Landing a $7M Seed Round

An important next step for Agora came in June 2021, when Bar and his team managed to land a $7M Seed round led by Aleph. Bar offers several insights gleaned from this stage:

Come from a position of strength: Agora had the opportunity to kickstart the seed round as early as February 2021 but decided to strengthen its position, raising an extra $1M in SAFEs to allow them to approach the Seed from a more confident place.

Prepare a detailed business plan: Business plans are always going to change (“I basically threw mine out a day after the round”, says Bar). But having a detailed business plan is useful as a jumping off point for discussions with investors around key business metrics.

Customize your story: Different stakeholders will be interested in different things, so you shouldn’t treat an investor meeting as another sales call.. For example, Investors are looking for high growth, while enterprise clients are much more concerned about stability. Tailor your presentation to your audience.

Key takeaway: To increase chances of success in an investment round, have a solid business plan, a company narrative tailored for investors, and financial stability.

Lessons Learned: The Evolution of a TAM Slide

During Agora's journey, Bar learned how to effectively articulate the market Agora was targeting. Here’s an illustrative example of what not to do when discussing your market:

The TAM (total addressable market) is too large: the slide indicates a TAM of $457B. While such a market may exist, what portion of it is relevant to Agora?

The immediate market is too narrow: the slide notes the immediate market is valued at $3B. This is too restrictive and doesn’t account for potential growth in the product. Investors want to see that there's room for (realistic) expansion.

Irrelevant information - why would you discuss your revenue goals as part of your market sizing?

This slide is from their pre-seed phase. By the time Agora reached the Series A round, the slide had evolved:

From seven bullet points, Agora distilled it down to two sentences.

“Between these two versions,” Bar mentions, “approximately four additional slides explain how to transform a company with a $10K ARR into a $5B enterprise by methodically expanding its TAM.”

Each Startup’s Journey is Different – But it’s Never Easy

Agora’s story demonstrates that startups are more than the glitzy headlines and overnight triumphs often portrayed in the media. The path to success is rigorous and demands unwavering resilience in facing challenges. It's a continuous process of learning and growth, relentlessly pushing the business forward through pivots, grit, and a lot of mistakes made along the way.

We hope you enjoyed this episode (and if you did, we’d love if you could tell a friend). As a reminder, all episodes are also available via Od Podcast.