Unblocking Your Round: How to Create FOMO and Seal the Deal with Investors

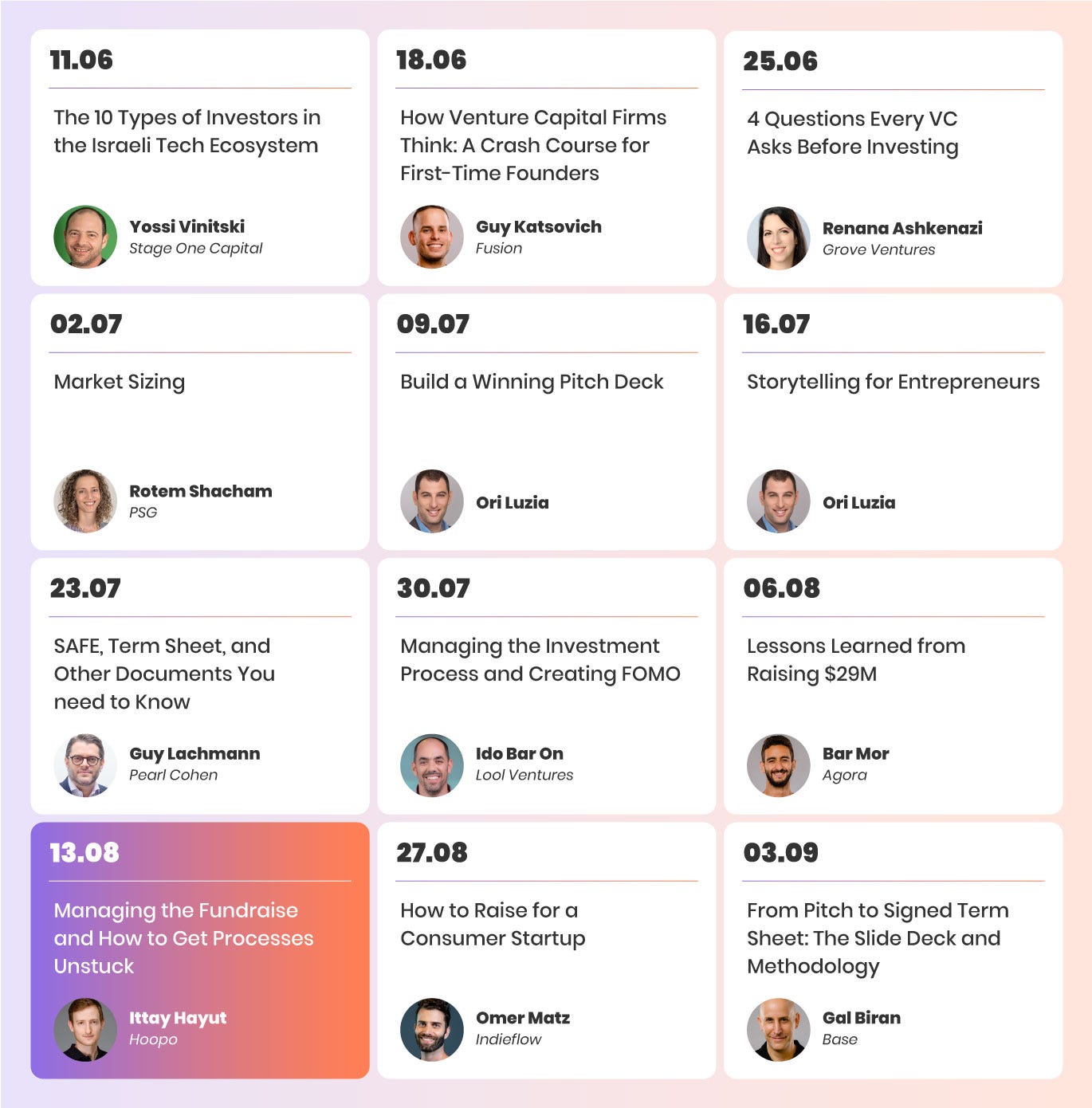

Masterclass, Episode #10: Learn how to deal with an investment process that isn't progressing, and how to create urgency without dependency

Watch the episode 👇

If you’ve already subscribed, check your email for the slides!

Episode Highlights

As with many other aspects of startup life, we tend to hear about the glamorous aspects of fundraising: the big round, the lucrative exit. The reality is that there’s a lot of hard work and disappointment before you reach these milestones. In many cases, you will find yourself stuck: struggling to get intros, failing to convince investors, or getting ‘ghosted’ in talks that refuse to move forward.

This Masterclass covers ways to get a fundraising process unstuck and make sure everything moves along nicely – including best practices and personal anecdotes from Hoopo’s fundraising journey, which led them to raise $17M up to their Series A in late 2022.

What you’ll learn:

How Hoopo pivoted twice to find product-market fit

The importance of personal intros, and how to get more of them

Creating FOMO and gently nudging investors towards a term sheet

About the expert:

Ittay Hayut is the Co-founder and CEO of Hoopo (a Fusion portfolio company), and a former commander in the IDF’s Intelligence Corps. Ittay holds an M.A. in cognitive psychology from Tel Aviv University.

How Hoopo Went from a MATLAB Formula to $17 Million in the Bank

As is the case with many startups, Hoopo went through multiple twists and turns before finding its direction as a company. When it started, it was basically a single MATLAB formula - an offering summarized in this slide from 2017:

You might not understand what’s written there (and we certainly don’t), but to simplify: The Hoopo team had a mathematical equation that could be used to track sensors in a cheaper and more efficient way compared to alternatives such as GPS. The technology was similar to airtags, except cheaper and with longer battery life - and it could be implemented entirely through software.

Based on this idea, and with sensor-enabled devices looking like the next big thing, Hoopo managed to raise initial runway funding (pre-pre-seed) to take their technology to market.

Pivot 1: Tech

Pretty soon, it became clear that Hoopo’s product was slightly ahead of the market. While the tech worked, they were struggling to find buyers for it since the sensors they had meant to track were not as commonly used as they had expected. This forced them to go back to the drawing board and find a way to make the technology not just useful - but commercially viable.

“We were looking for a problem with clear unit economics, where there’s room for growth, and where customers were already trying to solve it.”

This eventually led them to pivot on the product - introducing a new hardware component and a more holistic solution that also included cloud and analytics components.

With these elements in place, Hoopo identified a target market that would be willing to pay: the aviation industry, and specifically tracking fleets of airport carts. This direction was good enough to secure a Seed round in 2019.

Pivot 2: Market

You can probably see where this is going. In early 2020, COVID temporarily shut down most of the aviation industry. Companies in this space were no longer willing to spend, which hurt Hoopo’s business significantly.

This was a difficult period, during which the team had to ask itself hard questions about whether this idea still had a future. Eventually, they raised a SAFE round to keep the lights on. They used this time to find a new direction for the company in a world that was dealing with a whole new set of problems.

One of the most acute challenges that the pandemic introduced was the supply chain crisis. Changes in demand patterns, labor shortages and port closures led to bottlenecks where trucks and ships were simply stuck, eventually leading to empty shelves in supermarkets and long wait times for products.

Hoopo realized that their technology, which was originally designed for the aviation industry, could be used to help track containers, ships, and trailers. Hoopo’s solution would provide better tracking and visibility into these fleets, increasing efficiency in supply chains and mitigating the impact of future crises.

And so they pivoted once again, this time to focus on a broader market segment. This turned out to be an excellent decision as it unlocked new growth opportunities for the company - eventually leading them to raise a $10M Series A in August 2022.

Lessons Learned

As you can see, Hoopo’s ongoing journey knew many ups and downs, and required them to raise funds in different circumstances and across several iterations of their core idea. The rest of this article will cover what they learned in the process, which can be summarized in three key points:

1. Fundraising is a process that needs to be managed, not opportunistic. While there might be times an opportunity falls on your lap, this will not be the common scenario. The process needs to be structured, documented, and managed like a sales funnel to improve your odds of success.

2. Investors are people; fundraising is about relationships. When you understand the investor mindframe and what investors are looking for, you get a better idea of how to run the process and some of the advice you get starts to make more sense.

3. FOMO is key to getting things unstuck. Fear of missing out (FOMO) is one of the strongest forces in the world for getting people to take action. If investors experience FOMO, if they feel that this is an opportunity for them and not just for you, everything else will fall into place.

From these broad strategic tips, let’s drill down into some of the tactics.

Building your top-of-funnel

Like sales, fundraising is a numbers game. Out of one hundred investors you approach, only a fraction will respond to you. If you do things correctly, you can improve your ‘conversion rate’ by a few percentage points, but you’re going to need to approach a large number of people. To do that, you’re going to need credible intros.

The importance of intros goes back to the ‘investors are people’ point. “Imagine you’re asking someone on a date”, says Itay. “Would they be more likely to respond if you approach them out of the blue - or after someone they know tells them you’d be a good fit and asks them to ‘opt in’ to meeting you?”

Getting intros might take some work in itself. It’s an ongoing networking effort where you develop a group of people who know and - importantly - trust you. This is where the ‘credible’ comes in. Serious people will not risk their own reputation and relationships with investors by intro-ing someone they barely know.

Tip: When you request an intro, go ahead and suggest what to write as well. It saves everyone time and the intro-er will appreciate it. Here’s an example of what that type of intro would look like:

Keep things moving – creating urgency without dependency

Even after you’ve had a first meeting with an investor, you’re still in a funnel. Most of these meetings won’t materialize into term sheets. But here too, there are steps you can take to improve your odds.

We’ve mentioned the importance of FOMO. The secret to creating FOMO is to build a sense of urgency without dependency. Investors should understand that you need this money,, and you need it now - because you have a lot of great plans on what to do with it, because you have customers waiting for features, need to make hires, etc. But you shouldn’t appear needy. You want to create the impression that this train is leaving either way, and get the investor excited to jump on board.

How do you achieve this? One way is to make sure you’re meeting with multiple investors and getting different offers, so that you really are in a position where you aren’t fundraising with your back to the wall. But it’s also about how you manage the process and your communications with investors. Confidence and conviction are key.

Tip: Be smart about your use of ‘goody bags’ - email updates you send about recent wins and developments at the company. These emails are a great way to stay in touch with investors and remind them you exist, but if used correctly they can also create a greater sense of urgency. Rather than sending the same generic newsletter every two weeks, think about how you can send specific updates at the right time, based on the current stage of your discussions with a particular investor.

Sealing the deal

Once investors are convinced that you are the right team to invest in, they still need ways to de-risk that investment. This is done through validation signals (for your product) and by showing that you know how to manage the business side of things (for your team). Investors will have some questions to ask and some documents they’ll want to see - having everything ready from day one is another way to improve your odds.

For example, you know you’ll need to show your data room. You’ll need to present references. Prepare these materials in advance! “You’re always competing with other startup”, says Itay. “If you can send a link to your data room in two minutes and the other startup needs two days, it puts you at an advantage - and makes you look much more professional.”

Follow Best Practices, but Think Outside the Box

All of the above can give you a small edge, and marginally improve your odds of securing funding for your startup. But remember: you can’t rely exclusively on best practices, which most other entrepreneurs are also following. There are times when you need to get creative - come up with new ways to create FOMO, a better intro email, or a persuasive validation signal. (Needless to say, all of these should be grounded in reality!) It’s up to you to find the best way forward:

“As a founder, you’re paid to innovate. You need to bring that innovation to your fundraising process.”

We hope you enjoyed this episode (and if you did, we’d love if you could tell a friend). As a reminder, all episodes are also available via Od Podcast.